Interest rates have held steady since July 2023.

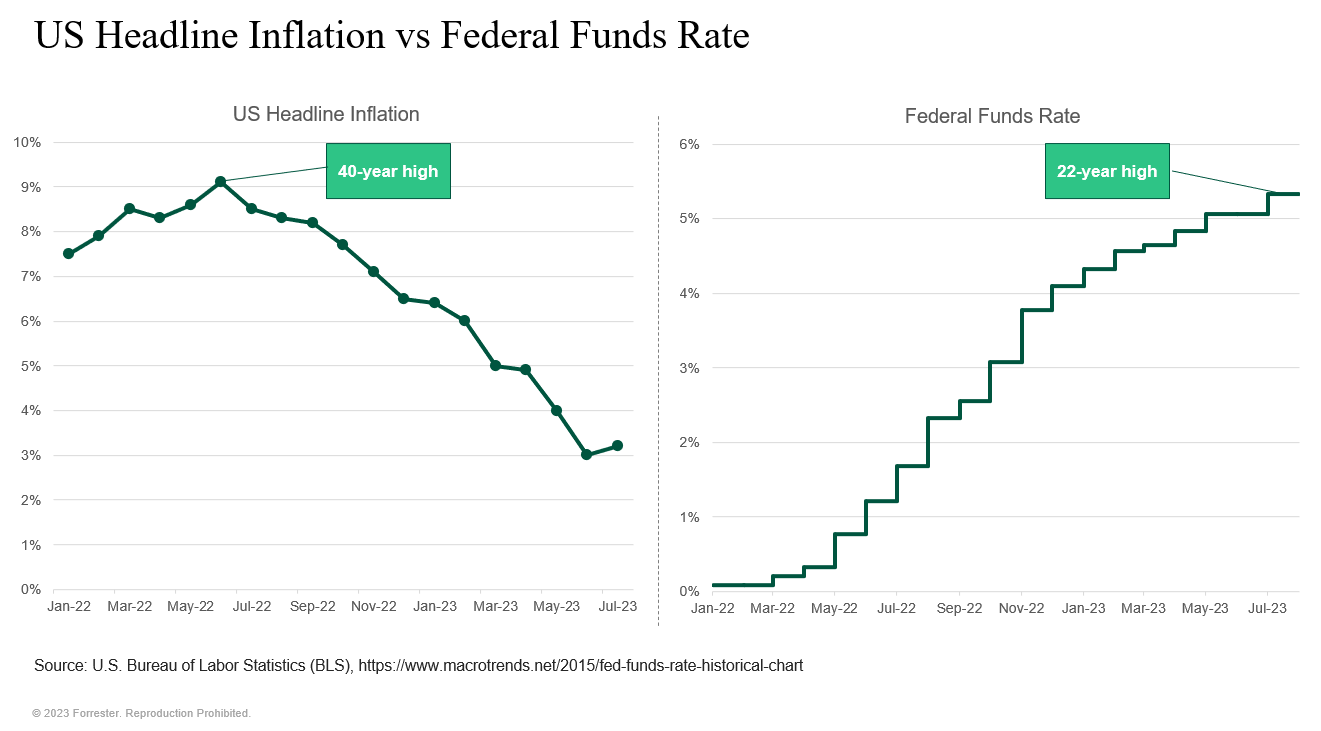

The federal funds target rate has remained at 5.25% to 5.5% since summer 2023, the highest it's been in over 20 years. The Fed raised the rate 11 times between March 2022 and July 2023 to combat ongoing inflation.The main tool the Fed uses to manage the economy and implement monetary policy is setting its key interest rate, which influences borrowing costs. Whenever it needs to cool the economy by making borrowing more expensive, the Fed raises rates, which should then bring down inflation.Higher interest rates tend to negatively affect earnings and stock prices (often with the exception of the financial sector). Changes in the interest rate tend to impact the stock market quickly but often have a lagged effect on other key economic sectors such as mortgages and auto loans.

Why interest rates are low in us : With ordinary Treasury bonds, people lend money to the U.S. government, but when they get their money back (with interest), each dollar they receive is worth less because of inflation. Thus, adjusting for inflation, the real rate of interest they receive is less than the nominal, or dollar, rate of interest.

How long will US interest rates stay high

Some economists — and, increasingly, investors — think that interest rates could stay higher in coming years than Fed officials have predicted. Central bankers forecast in March that rates will be down to 3.1 percent by the end of 2026, and 2.6 percent in the longer run.

What is the highest US interest rates have ever been : Interest rates reached their highest point in modern history in October 1981 when they peaked at 18.63%, according to the Freddie Mac data. Fixed mortgage rates declined from there, but they finished the decade at around 10%.

The US Fed has indicated it will cut interest rates in the latter half of 2024. It is an opportunity for investors to invest in debt funds and lock into current high yields and potential for future capital gains. US Federal Reserve expected to cut interest rates in the second half of 2024.

With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managers generally benefit from higher interest rates.

Will US interest rates go down in 2024

WASHINGTON (AP) — Federal Reserve officials signaled Wednesday that they still expect to cut their key interest rate three times in 2024, fueling a rally on Wall Street, despite signs that inflation remained elevated at the start of the year.The Fed's latest projections materials show that three rate cuts are still expected in 2024, bringing the rate down by three-quarters of a percentage point by the end of the year. However, the Fed's economic policy isn't set in stone.Countries with the highest deposit interest rates worldwide 2023. As of August 2023, the country with the highest deposit interest rate worldwide was Argentina, where the interest rate was as high as 113 percent. Second in the list came an African country, Zimbabwe, where the interest rate reached 110 percent.

Now, Fannie Mae expects rates to be a half-percent higher (6.4%) by the end of this year, and remain above 6% for another two years, gradually declining to a flat 6% by fourth-quarter 2025. Freddie Mac's latest data shows the average rate for a 30-year fixed mortgage is currently around 6.74%.

Where will interest be in 2025 : The average 30-year fixed mortgage rate as of Thursday was 6.99%. By the final quarter of 2025, Fannie Mae expects that to slide to 6.0%. Meanwhile, Wells Fargo's model expects 5.8%, and the Mortgage Bankers Association estimates 5.5%.

Why do banks make more money when interest rates rise : A rise in interest rates automatically boosts a bank's earnings. It increases the amount of money that the bank earns by lending out its cash on hand at short-term interest rates.

Who makes more money when interest rates rise

Unsurprisingly, bond buyers, lenders, and savers all benefit from higher rates in the early days. Bond yields, in particular, typically move higher even before the Fed raises rates, and bond investors can earn more without taking on additional default risk since the economy is still going strong.

Survey results show that interest rates could be near their peak, with a slow and steady decline ahead to 4.0 percent this year, 3.75 percent in 2025, and 3.63 percent in 2026.WASHINGTON (AP) — Federal Reserve officials signaled Wednesday that they still expect to cut their key interest rate three times in 2024, fueling a rally on Wall Street, despite signs that inflation remained elevated at the start of the year.

How high will rates go in 2024 : Mortgage giant Fannie Mae likewise raised its outlook, now expecting 30-year mortgage rates to be at 6.4 percent by the end of 2024, compared to an earlier forecast of 5.8 percent.