Yes, you can withdraw money from your 401(k) before age 59½. However, early withdrawals often come with hefty penalties and tax consequences. If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider.Withdrawing money from your 401(k) is not the same thing as cashing out. You can do a 401(k) withdrawal while you're still employed at the company that sponsors your 401(k), but you can only cash out your 401(k) from previous employers. Learn what do with your 401(k) after changing jobs.If you retire after age 59½, you can start taking withdrawals without paying an early withdrawal penalty. If you don't need to access your savings just yet, you can let them sit—though you won't be able to contribute.

Is 401k taxed in Germany : Article 18 assigns the right to tax such payments solely to Germany if the recipient is a German tax resident only. Under German tax rules and regulations, 401(k) payments are subject to income tax as other income because 401(k) plans are similar to certain pension plans in Germany.

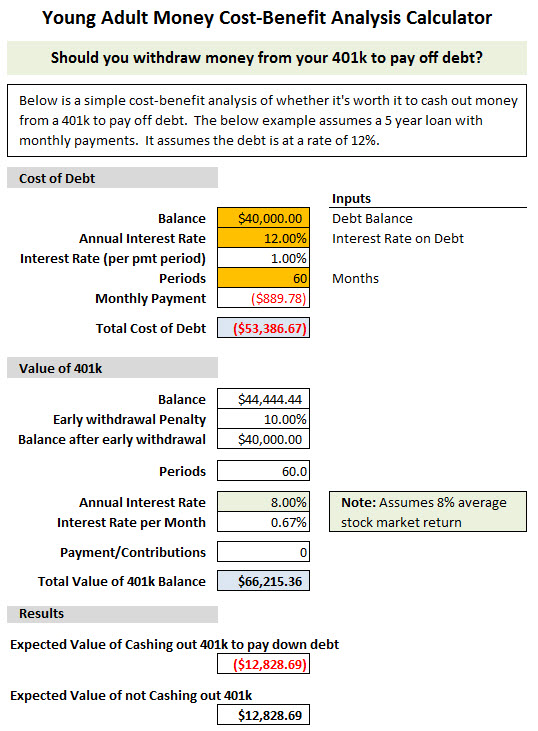

Should I withdraw my 401k to pay off debt

The short answer: It depends. If debt causes daily stress, you may consider drastic debt payoff plans. Knowing that early withdrawal from your 401(k) could cost you in extra taxes and fees, it's important to assess your financial situation and run some calculations first.

Can you move 401k to cash without penalty : Typically, you need to be at least age 59½ to withdraw from your 401(k). Any time before that may subject you to a 10% early withdrawal penalty. There are, however, some exceptions that allow you to bypass the penalty. You may make a withdrawal if you have a qualifying and permanent disability.

On a small scale like that, it might not seem impressive. But compounding interest and earnings is the most meaningful way that a 401(k) plan will continue to generate growth after you stop contributing.

This rule is based on research finding that if you invested at least 50% of your money in stocks and the rest in bonds, you'd have a strong likelihood of being able to withdraw an inflation-adjusted 4% of your nest egg every year for 30 years (and possibly longer, depending on your investment return over that time).

What are the benefits of 401k in Germany

The Betriebliche Altersvorsorge (bAV) is essentially the German equivalent of the US 401k plan, designed to help employees save for retirement. Both plans offer similar benefits such as tax advantages and employer matching, allowing for a reduction in taxable income and tax-free growth of investments.Betriebliche Altersvorsorge

Surprisingly, Germany also offers its own version of the 401k, known as the company pension or bAV (Betriebliche Altersvorsorge). In this blog post, we will explore whether obtaining a German 401k is a wise decision by considering the five crucial factors that significantly impact your retirement savings.Withdrawing money from your 401(k) has no impact on your credit. You can do an early withdrawal or a loan, but neither affects your credit or credit score.

About two-thirds of 401(k)s also permit non-hardship in-service withdrawals. This option, however, does not immediately provide funds for a pressing need. Instead, the withdrawal is allowed to transfer funds to another investment option.

Can I transfer my 401k to my bank account : Transferring Your 401(k) to Your Bank Account

That's typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

When should I take money out of my 401k : You're age 59 ½ to age 73, or 75

If you have a 401(k) plan sitting with a former employer, you can begin accessing those funds as early as 59½. You'll pay ordinary income taxes on amounts withdrawn but no penalty tax.

Does 401k double every 7 years

One of those tools is known as the Rule 72. For example, let's say you have saved $50,000 and your 401(k) holdings historically has a rate of return of 8%. 72 divided by 8 equals 9 years until your investment is estimated to double to $100,000.

By the time you turn 50, you should aim to have around six times your salary saved for retirement, according to Fidelity. So, if you earn $100,000, for example, ideally you should have around $600,000 sitting in your retirement savings account.The five-year rule also applies to funds held in a Roth 401(k) account. So if you've had a Roth 401(k) and a Roth IRA for at least five years and you've been actively contributing to both, then the five-year rule shouldn't be an issue for rollovers. To ensure this goes smoothly, be sure to plan ahead quite a bit.

Does 401k have 5 year rule : Contributions and earnings in a Roth 401(k) can be withdrawn without paying taxes and penalties if you are at least 59½ and had your account for at least five years. Withdrawals can be made without penalty if you become disabled or by a beneficiary after your death.

:max_bytes(150000):strip_icc()/howtotakemoneyoutofa401kplan-79531c969f74433db11c032e3cfd3636.png)