How do I get an EU VAT number To get a VAT number you have to apply locally through the relevant Member State's tax authority. Application timescales can vary so you should factor this in when planning to sell into the EU.How to get a German VAT number. You get a VAT number when you register your business with the Finanzamt. If you already registered your business, request a VAT number here. A small business (Kleinunternehmer) that does not charge VAT might not have a VAT number.VAT rates. EU law only requires that the standard VAT rate must be at least 15% and the reduced rate at least 5% (only for supplies of goods and services referred to in an exhaustive list).

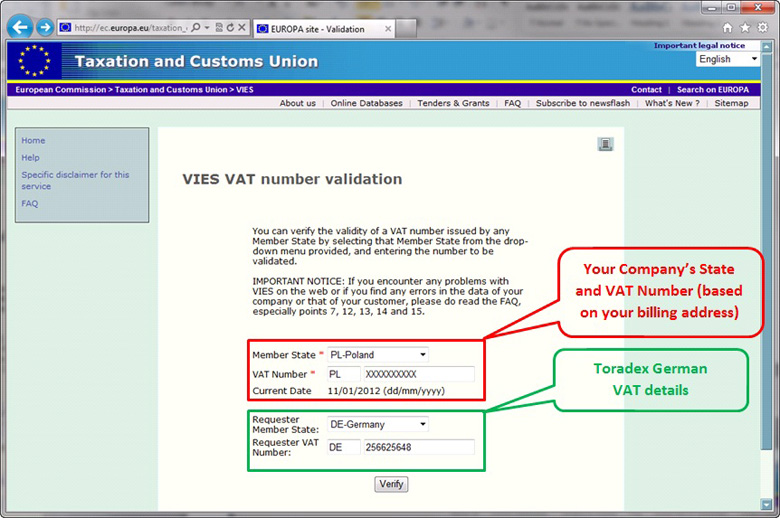

What is a VAT ID number in Europe : European Union VAT identification numbers. 'BE' + 8 digits + 2 check digits – e.g. BE09999999XX. As of recent changes, numbers starting with '1' are now issued. Note that the old numbering schema only had 9 characters, separated with dots (e.g. 999.999.

What happens if I don’t have a VAT number

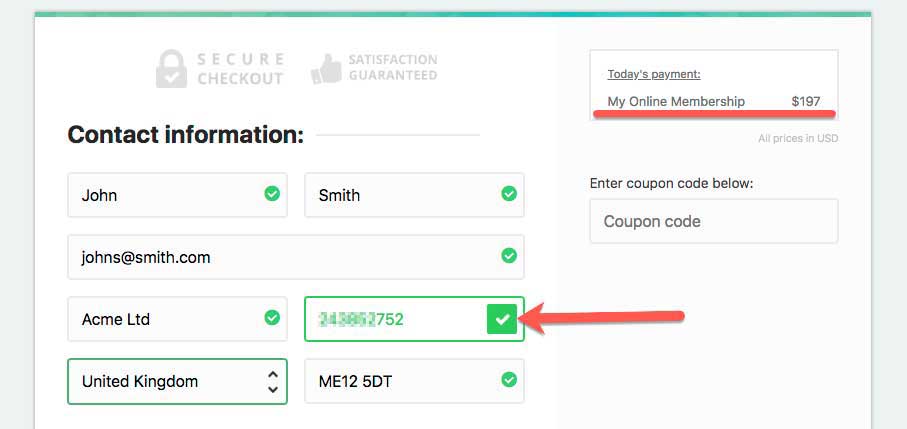

Individuals or organizations without a VAT number ordering from within the European Union will have to pay 21% VAT. We advise you to check with your administrative or financial department about having a VAT number before placing your order. If you are outside the EU, you do not need a VAT number.

Is it worth being VAT registered : Benefits of registering for VAT

If you register for VAT, you will reclaim VAT on all the goods and services you purchase. Input tax refers to the tax you pay on goods and services, whereas VAT is the output tax you charge. If your input is higher than your output, you will be able to claim it back through the HMRC.

How long does it take to get a VAT number If your file is complete, it generally takes one month to obtain the VAT number from the competent German tax office.

In Germany

You need to register for VAT if: You store goods in the Germany; and. You sell them to consumers based in the Germany; and. Your sales exceed the German VAT threshold.

Do I need to register for EU VAT

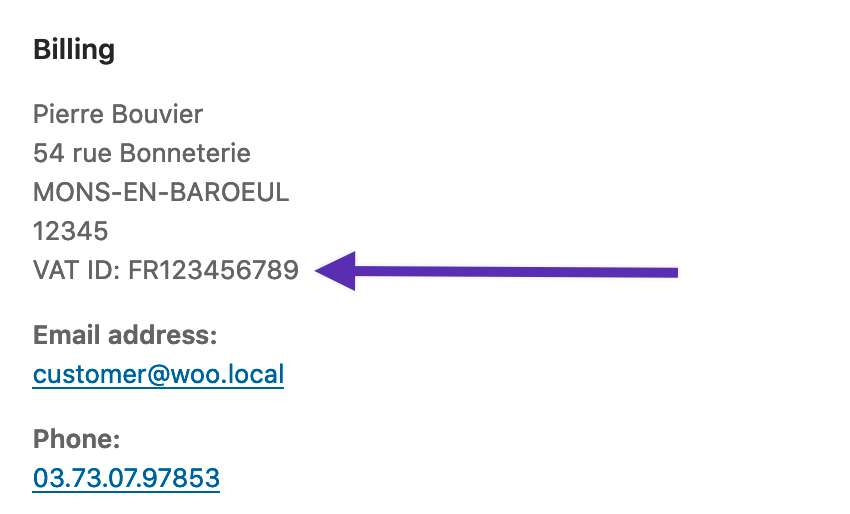

Non-EU businesses that sell goods located within the EU must register for the VAT OSS Union scheme in the EU country where the transport of the goods begins. If goods are transported from more than one country, the seller can choose the country of registration.The EU has standard rules on VAT, but these rules may be applied differently in each EU country. In most cases, you have to pay VAT on all goods and services at all stages of the supply chain including the sale to the final consumer.The Steuernummer is the tax number issued by the tax office where the business is registered. It is used in VAT returns and for all correspondence, audits, and day-a-day issues with the tax authorities. The VAT ID number, often referred as USt-IdNr, is the VIES number, used for all intra-Community transactions.

You must register if you realise that your annual total VAT taxable turnover is going to go over the £90,000 threshold in the next 30 days. You have to register by the end of that 30-day period. Your effective date of registration is the date you realised, not the date your turnover went over the threshold.

Is it OK to not be VAT registered : If you are not VAT registered you still have to pay the VAT on your purchases but are unable to reclaim it. Those who suffer in paying the actual tax, are the non-VAT registered businesses and individuals, at the bottom of the chain.

Can I invoice without a VAT number : A non-VAT invoice does not need to detail applicable VAT amounts and should not show a VAT registration number. While many business owners keep digital records of their VAT invoices, this is not required for invoices without VAT. Input VAT cannot be claimed from an invoice without VAT.

What happens if you are not VAT registered

Can you charge VAT if not VAT registered just yet The answer to this question is no, and the rules are quite clear on this issue. According to the Finance Act of 2008, businesses that issue an invoice showing VAT when they are not registered are liable to pay a penalty up to 100% of the amount shown on the invoice.

You can earn respect and recognition by registering too. If you're not registered for VAT, other companies will know that your turnover is below a certain level and they may choose to make assumptions about your business based on that.In Germany

You need to register for VAT if: You store goods in the Germany; and. You sell them to consumers based in the Germany; and. Your sales exceed the German VAT threshold.

Who should register for VAT in Germany : Businesses are required to register for VAT in Germany when the annual turnover exceeds a certain value. The registration requirements apply to both residents and non-residents, however, reduced rates (as described above), as well as a scheme for small businesses, applies to companies.