Contact HMRC: If you're unable to locate your VAT number, you can contact HMRC for assistance. You can call the VAT helpline on 1800 or 0300 200 3700 or send an email to the VAT general inquiries mailbox at [email protected]. You can also reach out to HMRC online through the live chat.Foreign businesses must be registered in Germany before applying for a German VAT number. To do so, you can check here which tax office is responsible for your country of origin. You can request the VAT number directly while registering at the tax office.Getting a VAT number means obtaining a tax identification number in a foreign country to carry out trading taxable activities. You should not confuse getting a VAT number with setting up a branch (permanent establishment) or incorporating a subsidiary.

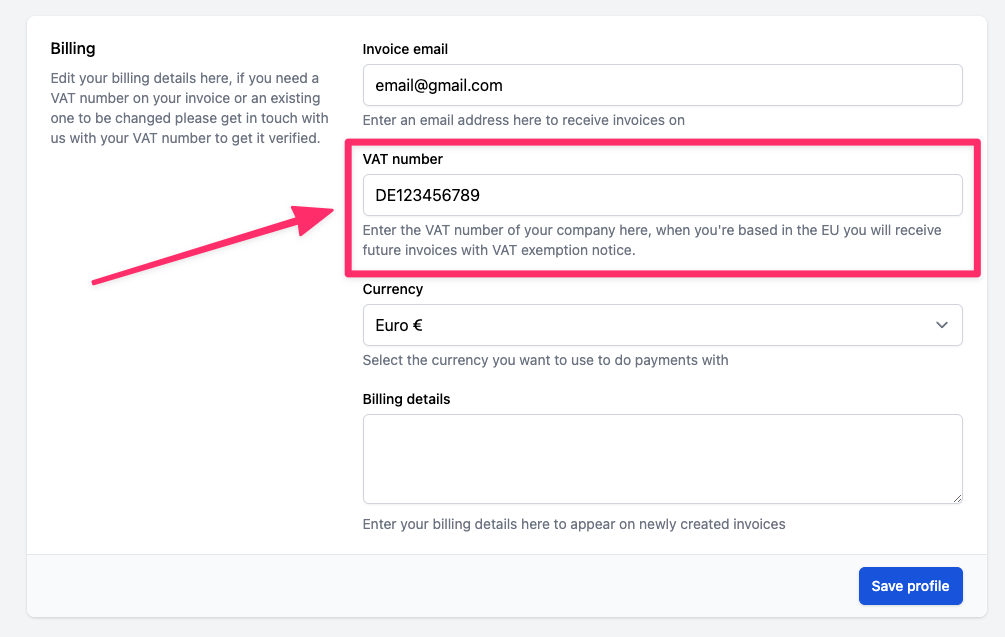

What is the VAT ID in Germany : The Umsatzsteuer-ID is the German VAT number. It's a 9 digit number with the format “DE123456789”. It's also called Umsatzsteuer-Identifikationsnummer, USt-Identifikationsnummer or USt-IdNr. The tax VAT number is for businesses that charge VAT.

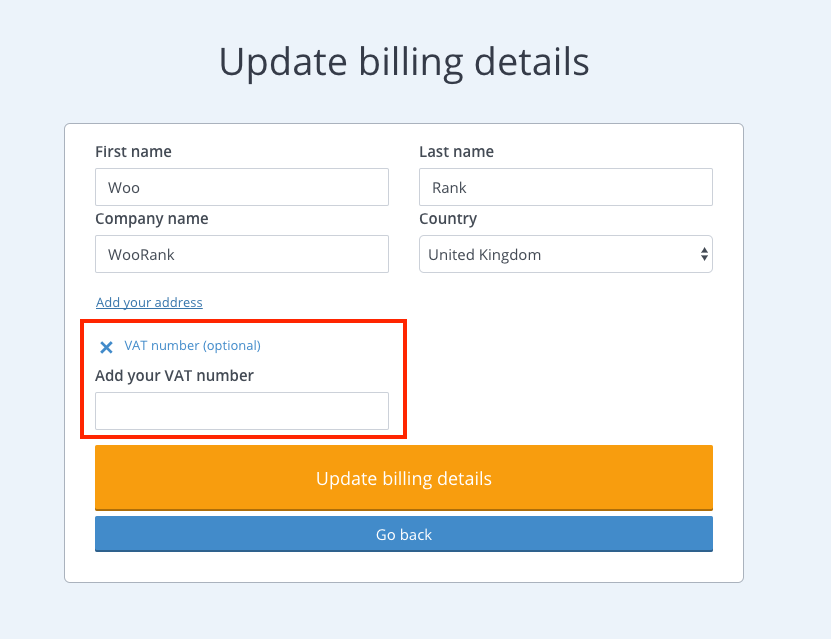

Do I need a VAT number

You must register if you realise that your annual total VAT taxable turnover is going to go over the £90,000 threshold in the next 30 days. You have to register by the end of that 30-day period. Your effective date of registration is the date you realised, not the date your turnover went over the threshold.

How do I know if my receipt is VAT : On bills and receipts

Sometimes VAT is shown on a separate line. This does not mean you're paying extra – it just shows how much tax is included in the price. Invoices from suppliers like builders, painters and decorators must show a separate amount for VAT and their VAT registration number.

German VAT Refund

- the original receipt of the store,

- the purchased goods (unused/unworn in its original packaging and with price tag),

- your passport showing residence outside the EU and.

- the used flight tickets as proof of stay in Germany.

How long does it take to get a VAT number If your file is complete, it generally takes one month to obtain the VAT number from the competent German tax office.

How do I get a VAT number in the EU

How do I get an EU VAT number To get a VAT number you have to apply locally through the relevant Member State's tax authority. Application timescales can vary so you should factor this in when planning to sell into the EU.Individuals or organizations without a VAT number ordering from within the European Union will have to pay 21% VAT. We advise you to check with your administrative or financial department about having a VAT number before placing your order. If you are outside the EU, you do not need a VAT number.Businesses providing taxable supplies in Germany may be required to apply for a German VAT number. The conditions include: Importing into Germany, Buying and selling goods within Germany.

How long does it take to get a VAT number If your file is complete, it generally takes one month to obtain the VAT number from the competent German tax office.

Can I claim VAT back : You can reclaim VAT on items you buy for use in your business if you're VAT registered. Do this in your VAT return. There are different rules if your organisation is VAT-exempt (for example, an educational academy or an eligible charity).

What do I do if I don’t have a VAT receipt : There might be a reason that you can't obtain one from the supplier. In this situation HMRC will accept a claim for VAT where you can show to its satisfaction that: the purchase actually took place, this might include alternative documentary evidence. it was a purchase for your business.

Can I claim VAT without a receipt

Businesses often ask if they can claim input VAT without a VAT invoice. The common misconception is that VAT cannot be recovered without an original paper receipt. The easiest way to demonstrate input VAT recovery is by holding a valid VAT invoice. Sometimes all you have is an item on a bank or credit card statement.

The standard VAT rate in Germany is 19%. Germany will reimburse between 11.4% and 13.6% of the amount you spend during your trip on products subject to standard VAT rates.What should I consider in the stores if I want to buy tax-free

- Look for stores with a Tax Free sticker.

- Ask at the cash desk area for a Tax Free form.

- You will get a Tax Free form stapled together with your sales receipt, handed in an envelope.

- Please fill in this form with your address and sign it!

How do I claim my VAT refund online : How to access the electronic VAT refund service

- click on the 'My Services' homepage.

- select 'File a Return' option from 'Complete a Form-Online'

- select 'EVR' from the 'Tax Type' option list.

- select 'EU Vat Refund Applic” from the 'Select a return type' option list.

- click the 'File Return' button.