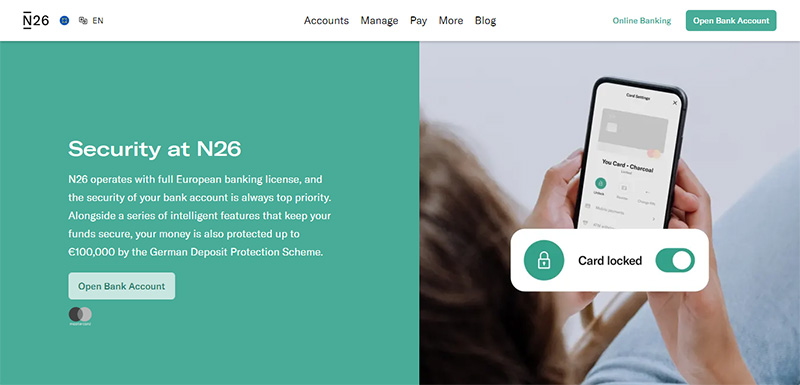

The security of your money is always our top priority at N26. And not only is your bank account protected up to €100,000 by the German Deposit Protection Scheme, but it also comes packed with a series of intelligent features that keep your funds safe. For more information, check out Security at N26.More than an app: A fully licensed bank

N26 is a fully licensed German bank. That means we have the same security regulations as any other bank. It also means your funds are protected up to €100,000 by the German Deposit Protection Scheme.Cons

- 1.7% charge for withdrawing cash abroad with the basic account.

- No bank branches.

- No telephone support and reduced hours chat support.

- No guaranteed financial protection with Brexit.

- No standing orders.

- No overdraft facility.

Is N26 a real bank account : N26 operates with a full German banking license, and your bank account with a German IBAN is protected up to €100,000, according to EU directives. And with fingerprint identification and advanced 3D Secure technology, you can rest assured you're extra safe when making purchases in stores and online.

What is the best bank in Germany

With over 1,800 banks in total, Germany has an extremely fragmented but stable banking industry.

- HypoVereinsbank.

- Sparkassen.

- N26.

- Deutsche Bundesbank.

- Postbank.

- Hamburg Commercial Bank. Operational HQ: Hamburg.

- Landesbank Hessen-Thüringen. Operational HQ: Frankfurt.

- Norddeutsche Landesbank. Operational HQ: Hannover.

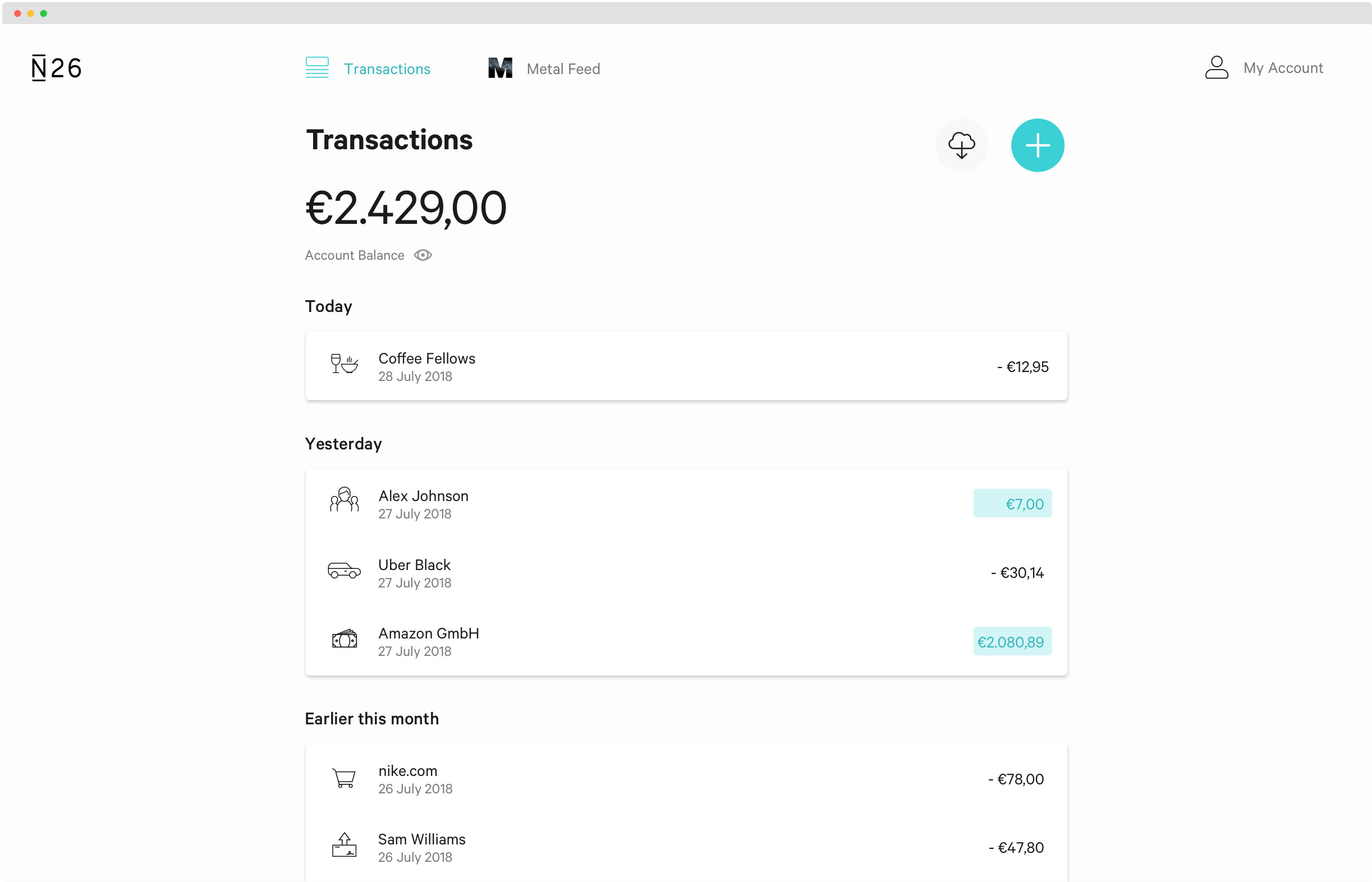

How to save money in N26 : Set and meet your savings goals

The simplest way to create good saving habits Create a dedicated savings account with N26 where you can watch your savings fund grow. N26's Spaces sub-accounts allow you to create multiple savings accounts and set savings goals for each of them.

N26

| Formerly | Number 26 (2013–2016) |

|---|---|

| Key people | Valentin Stalf (co-CEO) Maximilian Tayenthal (co-CEO) |

| Services | Direct bank |

| Revenue | 120,375,000 Euro (2021) |

| Owner | N26 AG |

Carina Kozole, Managing Director and Chief Risk Officer.

What is the N26 controversy

Controversies

- Account closures. In October 2022, it was reported that over 100 customers had their N26 bank accounts closed unexpectedly and without prior notice.

- Anti-Money laundering compliance issues.

- Business strategy.

- Security incidents.

- Works council.

Some industry observers have chalked up N26's US failure to reasons like “global banking is hard,” and “the US is a hostile regulatory environment.” These might be contributing factors, but the seeds of N26's US failure were sown right from the very start of its launch in July 2019: 1) Incorrect market assumptions.Is N26 better than Commerzbank N26 is comparatively a better option than Commerzbank when it comes to everyday banking, but if you are looking for investing options, then Commerzbank is the best German bank!

HSBC Holdings PLC

British financial institution HSBC Holdings PLC is the largest bank in Europe in terms of assets, with a total balance sheet of 2.6 trillion euros.

Does N26 have a monthly fee : Your N26 account comes with no minimum balance fees and no account maintenance fees.

What is the 30 day rule : The premise of the 30-day savings rule is straightforward: When faced with the temptation of an impulse purchase, wait 30 days before committing to the buy. During this time, take the opportunity to evaluate the necessity and impact of the purchase on your overall financial goals.

Why did N26 close

According to CNBC: “N26′s 500,000 American customers will no longer be able to use its app from Jan. 11, 2022. The Berlin-based fintech, which was valued at $9 billion in a recent funding round, said it wanted to shift focus to its core European business.”

N26's business model is designed for diversification. The subscription fees from premium services like “N26 Black” and “N26 Metal” serve as primary revenue sources. N26 further bolsters its income streams through usage fees, specialized business accounts, and value-added services such as insurance.In May 2021 BaFin demanded that N26 take actions to prevent money laundering and terrorism financing. And in June 2021, the bank was fined 4.25 million euros by BaFin for weaknesses in its anti-money laundering system. At least 50 transactions were suspicious and occurred between 2019 and 2020.

Why is Revolut better than N26 : Similarly, when it comes to taking out cash abroad N26 will offer you a charge of 1.7% on all transactions, while Revolut offers free transactions up to €200 a month with a 2% charge added after this limit. This is far better than the current 3-4% offered by most Irish banks.