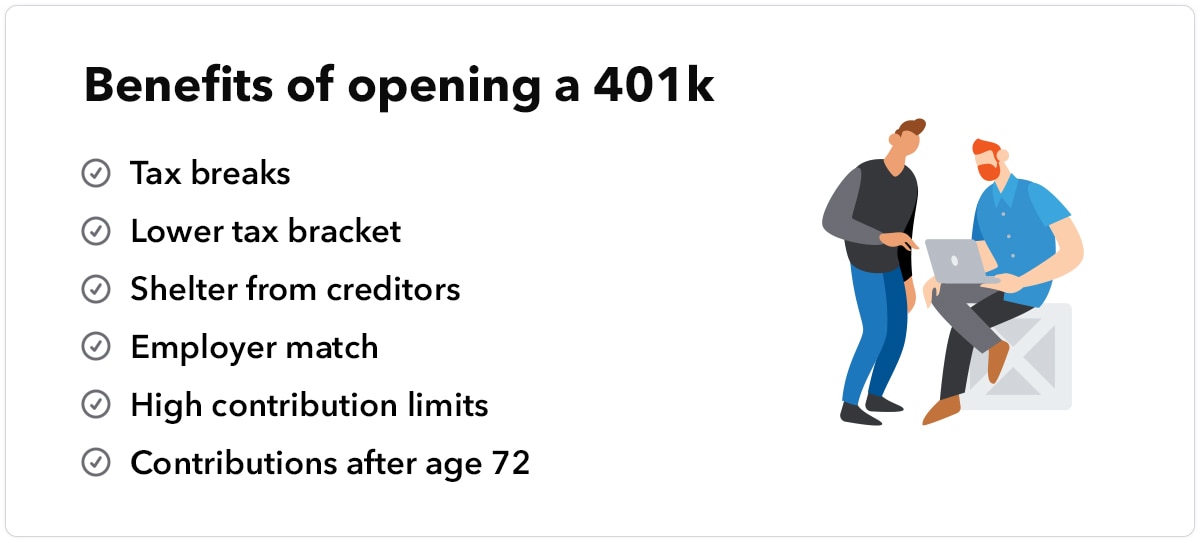

401(k) Benefits. 401(k)s offer workers a lot of benefits, including tax breaks, employer matches, high contribution limits, contribution potential at an older age, and shelter from creditors.Some of the considerations to keep in mind with a 401(k) include:

- Pro: You can place funds into the plan every year.

- Con: You might not be able to save enough.

- Pro: Employers might add to the account.

- Con: Contributions from employers might be minimal.

- Pro: Maintaining the account can be simple.

Betriebliche Altersvorsorge

Surprisingly, Germany also offers its own version of the 401k, known as the company pension or bAV (Betriebliche Altersvorsorge). In this blog post, we will explore whether obtaining a German 401k is a wise decision by considering the five crucial factors that significantly impact your retirement savings.

Is it a good idea to have a 401k : While 401(k) plans are a valuable part of retirement planning for most U.S. workers, they're not perfect. The value of 401(k) plans is based on the concept of dollar-cost averaging, but that's not always a reliable theory. Many 401(k) plans are expensive because of high administrative and record-keeping costs.

What are the disadvantages of a 401k

There are, however, some challenges with a 401(k) plan.

- Most plans have limited flexibility as it relates to quality and quantity of investment options.

- Fees can be high especially in smaller company plans.

- There can be early withdrawal penalties equal to 10% of the amount withdrawn before age 59 1/2.

What happens to 401k when you quit : If your 401(k) has less than $1,000 when you quit a job, the IRS allows the plan administrator to automatically withdraw your money and send you a check, minus 20% in taxes, per the IRS. You can also initiate a rollover: a direct transfer of your money from a 401(k) account to another tax-advantaged retirement account.

There are, however, some challenges with a 401(k) plan.

- Most plans have limited flexibility as it relates to quality and quantity of investment options.

- Fees can be high especially in smaller company plans.

- There can be early withdrawal penalties equal to 10% of the amount withdrawn before age 59 1/2.

They're a great way to save for retirement because they come with special tax advantages and most employers offer a company match on your contributions (which is free money). Generally, there are two types of 401(k) plans out there: traditional and Roth.

Is 401k taxed in Germany

Article 18 assigns the right to tax such payments solely to Germany if the recipient is a German tax resident only. Under German tax rules and regulations, 401(k) payments are subject to income tax as other income because 401(k) plans are similar to certain pension plans in Germany.The number of years worked, your age, and your average income all determine the overall pension rate. The net replacement rate of the German pension (the percentage of your average salary your pension equates to) is 53%.A 401(k) is a great retirement savings account, and you should contribute enough to get your full employer match. A 401(k) has limited investment options, and distributions count in determining if Social Security is taxable. You may not be able to take the money out of a 401(k) right away if you retire early.

There are, however, some challenges with a 401(k) plan.

- Most plans have limited flexibility as it relates to quality and quantity of investment options.

- Fees can be high especially in smaller company plans.

- There can be early withdrawal penalties equal to 10% of the amount withdrawn before age 59 1/2.

Who should not use a 401k : If you earn, say, $50,000 per year, then stashing more than 40% of your salary into a 401(k) will almost certainly not make sense. Also, your company's 401(k) plan may be too costly with a poor investment lineup.

Is a 401k or IRA better : The right answer for you depends on your income, retirement goals, and other financial details. 401(k)s are a good idea for nearly any employee who can participate, especially if a match is available. IRAs are great for anyone who doesn't have a retirement account through work.

Can you cash out your 401k

Most Americans retire in their mid-60s, and the Internal Revenue Service (IRS) allows you to begin taking distributions from your 401(k) without a 10% early withdrawal penalty as soon as you are 59½ years old.1 But you still have to pay taxes on your withdrawals.

Fidelity says by age 40, aim to have a multiple of three times your salary saved up. That means if you're earning $75,000, your retirement account balance should be around $225,000 when you turn 40. If your employer offers both a traditional and Roth 401(k), you might want to divide your savings between the two.So to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. By age 50, you would be considered on track if you have three-and-a-half to six times your preretirement gross income saved.

How can I avoid double taxation in Germany : If a double tax treaty (DTT) exists, double taxation is usually avoided by exempting the foreign income with progression. Foreign income taxes can only be credited against German income tax if a tax credit is provided in the applicable DTT or a DTT does not exist.

:max_bytes(150000):strip_icc()/definedcontributionplan.asp-final-a4dd25604f494d7c80dd2097d58cebd9.png)