Using independent, third party auditors and audits, cultivating a more diverse board of directors, implementing data protection measures, improving executive accountability, or drafting, updating, communicating, and training employees on important ESG policies are all examples of ESG governance in action.ESG Standards

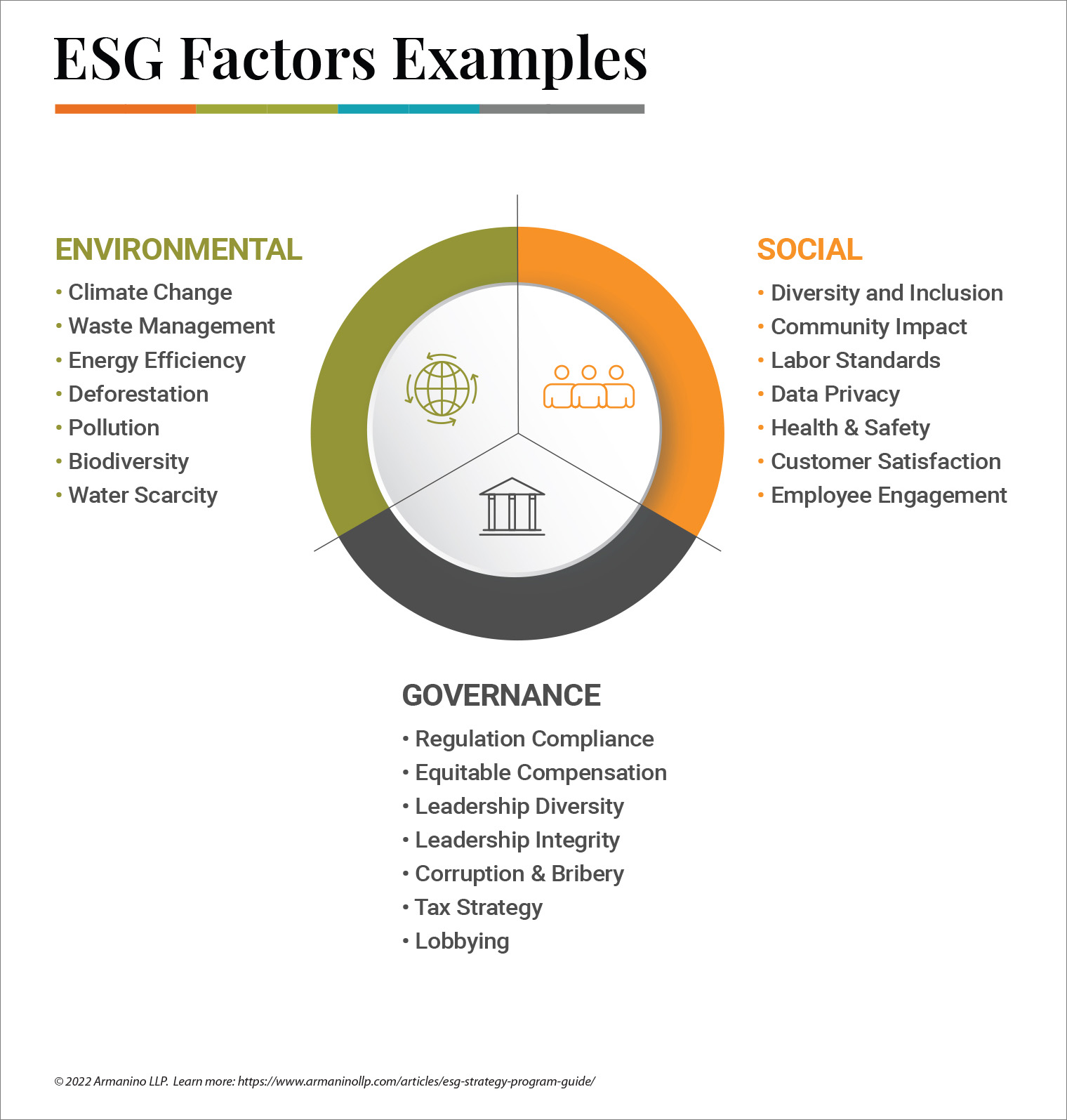

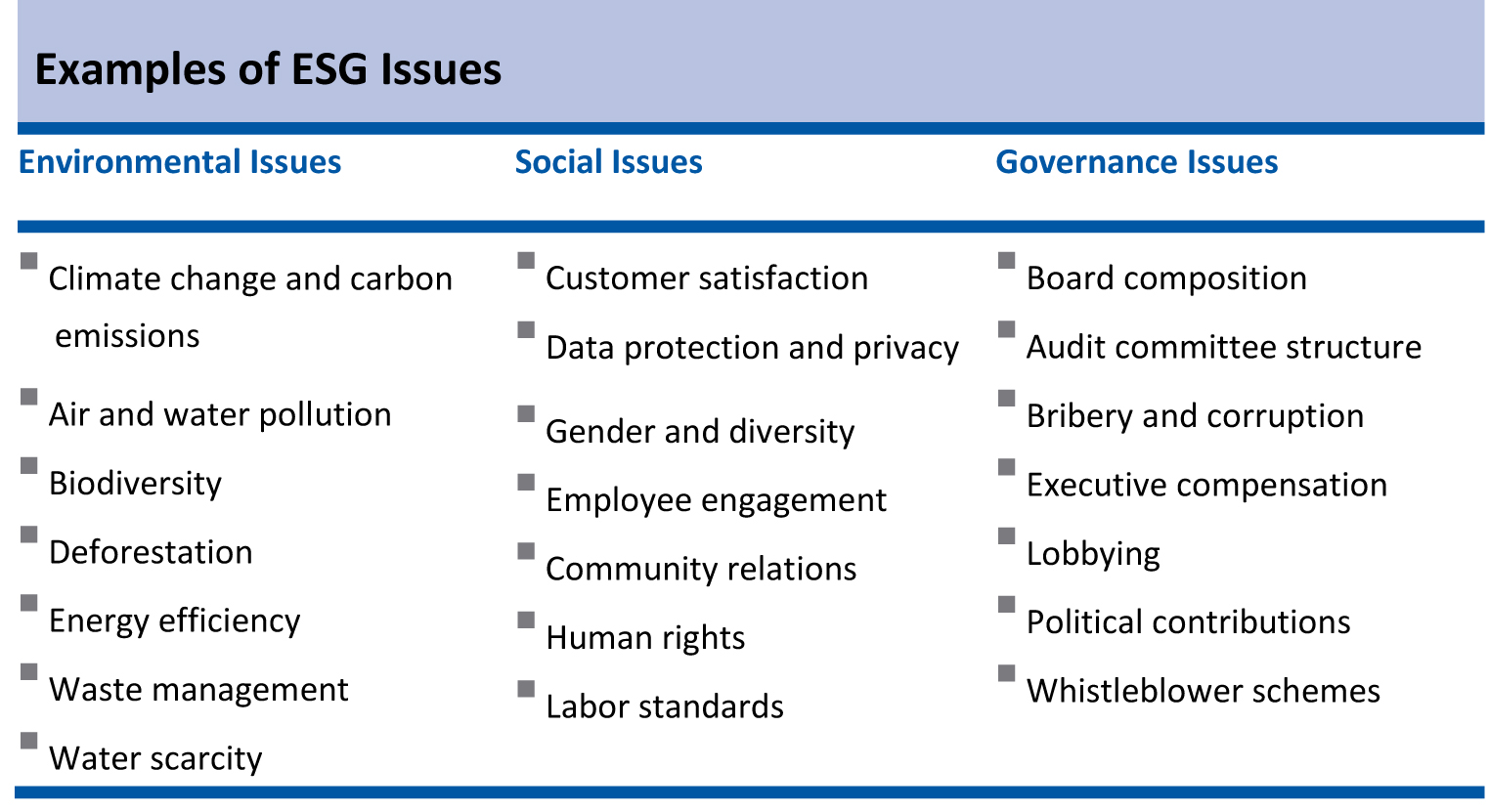

| Environmental | Social | Governance |

|---|---|---|

| Considers how a company performs as a steward of nature. | Examines how a company manages relationships with employees, suppliers, customers and communities where it operates. | Measures a company's leadership, executive pay, audits, internal controls and shareholder rights. |

What are the components of governance

- Board composition.

- Business integrity.

- Corporate leadership.

- Competitive practices.

- Ethics.

- Incentive structures.

- Political activities.

- Transparency.

What is the governance pillar of ESG : What falls under the Governance Pillar The main issues reported under the Governance Pillar are shareholders rights, board diversity, how executives are compensated and how their compensation is aligned with the company's sustainability performance.

What is an example of governance

For instance, a government may operate as a democracy where citizens vote on who should govern and the public good is the goal, while a non-profit organization or a corporation may be governed by a small board of directors and pursue more specific aims.

What are ESG governance issues : Governance issues and what they mean

It includes the rules for decision-making, accountability, performance evaluation, operational strategies, and more. These are important considerations when assessing an organization's ESG performance. Good governance leads to good outcomes.

Governance is a critical aspect of ESG, even if it's not always discussed as much. Strong governance and controls can help organisations improve performance, mitigate risk, and meet critical reporting and regulatory requirements.

Ethics, risk management, compliance and administration are all elements of governance. Other useful definitions of governance are provided below. Corporate governance involves a set of relationships between a company's management, its board, its shareholders and other stakeholders.

What are the 4 types of governance

For this purpose, the article presents what I consider to be the four most popular approaches to the concept of governance: corporate governance, global governance, good governance, and modern governance.Governance is the process whereby elements in society wield power and authority, and influence and enact policies and decisions concerning public life, economic and social development.”Practicing good governance helps create long-term value

Businesses can practice good governance by applying clear policies and practices for boards, employees, operations and supply chains to support more sustainable outcomes.

What Are Some Potential Governance Risk Issues

- Executive Compensation.

- ESG Inaction.

- Customer Data Usage.

- ESG Investment Decisions.

What are the 4 P’s of governance : The Pillars of Corporate Governance

It's built on four pillars that we like to call the 4 P's: People, Processes, Performance, and Purpose.

What are the 5 principles of governance : Good governance is underpinned by five core principles. An organization that uses good governance is one that always, in word and action, demonstrates: accountability; leadership; integrity; stewardship; and transparency (the A – LIST).

What does governance mean in sustainability

Governance for sustainability is defined as the set of written and unwritten rules that link ecological citizenship with institutions and norms of governance. It is a complex topic because it addresses the three issues of globalization, democracy and sustainability.

Summary. In conclusion, the "G" in ESG is crucial when evaluating an organisation's impact on the world. Good governance is vital for an organisation's long-term success and includes risk management, decision-making, transparency, compliance, and ethical behaviour.What Are Some Potential Governance Risk Issues

- Executive Compensation.

- ESG Inaction.

- Customer Data Usage.

- ESG Investment Decisions.

What are the six governance indicators : Based on a long-standing research program of the World Bank, the Worldwide Governance Indicators capture six key dimensions of governance (Voice & Accountability, Political Stability and Lack of Violence, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption) between 1996 and present.