On the basis of these inflation forecasts, average consumer price inflation should be 3.3% in 2024 and 1.9% in 2025, compared to 4.06% in 2023 and 9.59% in 2022.HICP inflation is projected to reach 2.8% in 2024 and 2.4% in 2025. This is broadly in line with the Autumn Forecast.A combined report from leading economic think tanks in Germany has revised 2024 growth forecasts from 1.2% down to 0.1%. The country is also expected to dip into a technical recession after the first quarter.

How is Germany’s economy : With a gross domestic product (GDP) of 4.121 billion euros in 2023, Germany is the third-largest economy in the world after the United States and China, and thus also the largest economy in Europe.

What will inflation be in 2025

Headline inflation was expected to decline from 2.4% in 2024 to 2.0% in both 2025 and 2026 (see Chart 1). Respondents' qualitative explanations indicate that the main reasons behind the expected profile of inflation were similar to those given in the previous survey round.

What is the projected inflation rate for the next 5 years UK : Annual inflation rate of the Consumer Price Index in the United Kingdom from 2000 to 2028

| Characteristic | Inflation rate forecast |

|---|---|

| 2025* | 1.5% |

| 2024* | 2.2% |

| 2023* | 7.3% |

| 2022 | 9.1% |

According to the government forecast, inflation in Europe's biggest economy is expected to fall to 2.8% this year and be at 1.9% in 2025, the source added. Get a look at the day ahead in European and global markets with the Morning Bid Europe newsletter.

The headline rate will diminish to 2.8% by 2025. By contrast, the core rate (excluding energy and food) will first continue to rise slightly in 2023, climbing to 4.3%. It will subsequently decline to 2.6% by 2025.

What will Germany’s growth rate be in 2025

KfW Research expects German GDP to grow by a moderate 0.3% in all of 2024 (previous forecast: +0.6%). GDP growth is likely to accelerate to 1.2% in 2025 (initial forecast).Real gross domestic product will probably decline again slightly in the first quarter of 2024, according to the March Monthly Report. The German economy continues to experience headwinds from various directions."Output could decline again slightly in the first quarter of 2024. With the second consecutive decline in economic output, the German economy would be in a technical recession." Despite a weak outlook, the bank has said it does not expect an extended recession.

The dollar had an average inflation rate of 3.08% per year between 2022 and 2030, producing a cumulative price increase of 27.43%. The buying power of $1,000,000 in 2022 is predicted to be equivalent to $1,274,332.17 in 2030.

What is the predicted inflation rate for 2026 : Buying power of $10,000 in 2026

| Year | Dollar Value | Inflation Rate |

|---|---|---|

| 2023 | $11,244.86 | 4.12% |

| 2024 | $11,452.40 | 1.85% |

| 2025 | $11,795.98 | 3.00% |

| 2026 | $12,149.86 | 3.00% |

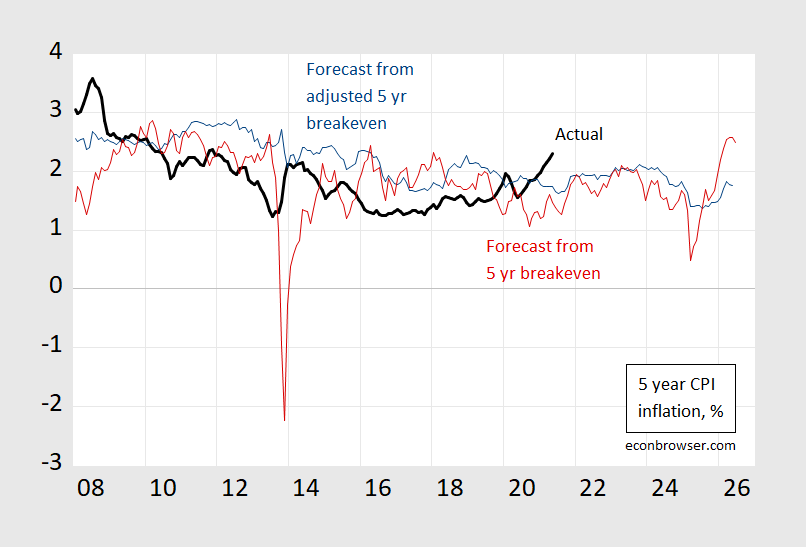

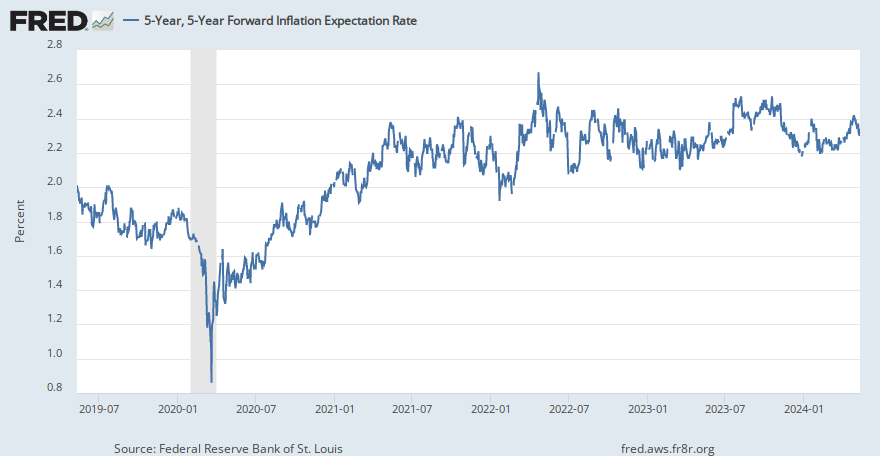

What is 5 year 5 year forward inflation : The 5Y/5Y forward uses the difference in market interest rates for a period of 5 years, beginning 5 years in the future. In general, you subtract an average of 5Y bonds from an average of 10Y bonds.

What is 5 year 5 year inflation

Measures the expected inflation rate (on average) over the five-year period that begins five years from today. The current 5 Year 5 Year inflation expectation rate as of April 10, 2024 is 2.31.

Contrary to expectations, the German economy is in recession in the winter half-year 2023/24. In particular, a recovery in industrial activity will not set in until later. Economic weakness will slow down employment growth and initially cause unemployment to rise further.EU HICP inflation is forecast to fall from 6.3% in 2023 to 3.0% in 2024 and 2.5% in 2025. In the euro area, it is projected to decelerate from 5.4% in 2023 to 2.7% in 2024 and to 2.2% in 2025. Last year's modest growth largely owes itself to the momentum of the post-pandemic economic rebound in the previous two years.

How high will interest rates be in 5 years : Mortgage rates are expected to decline later this year as the U.S. economy weakens, inflation slows and the Federal Reserve cuts interest rates. The 30-year fixed mortgage rate is expected to fall to the mid- to low-6% range through the end of 2024, potentially dipping into high-5% territory by early 2025.