The annual inflation rate in the US rose for a second consecutive month to 3.5 percent in March 2024 from 3.2 percent in February, raising questions on when the Fed will start to cut interest rates.After its December 2023 meeting, the Federal Open Market Committee (FOMC) predicted making three quarter-point cuts by the end of 2024 to lower the federal funds rate to 4.6%. Inflation has started to recede, but the committee has signaled it wants to see more positive data before pulling the trigger.Fed wants more confidence that inflation is moving toward 2% target, meeting minutes indicate. Federal Reserve officials at their March meeting expressed concern that inflation wasn't moving lower quickly enough, though they still expected to cut interest rates at some point this year.

What is the Fed rate meeting in March 2024 : The Federal Open Market Committee (FOMC) announced on March 20 that it would maintain its policy rate in a range of 5.25% to 5.5%. The March decision marks the fifth consecutive meeting at which the Federal Reserve (Fed) has opted to hold interest rates steady.

What is inflation right now

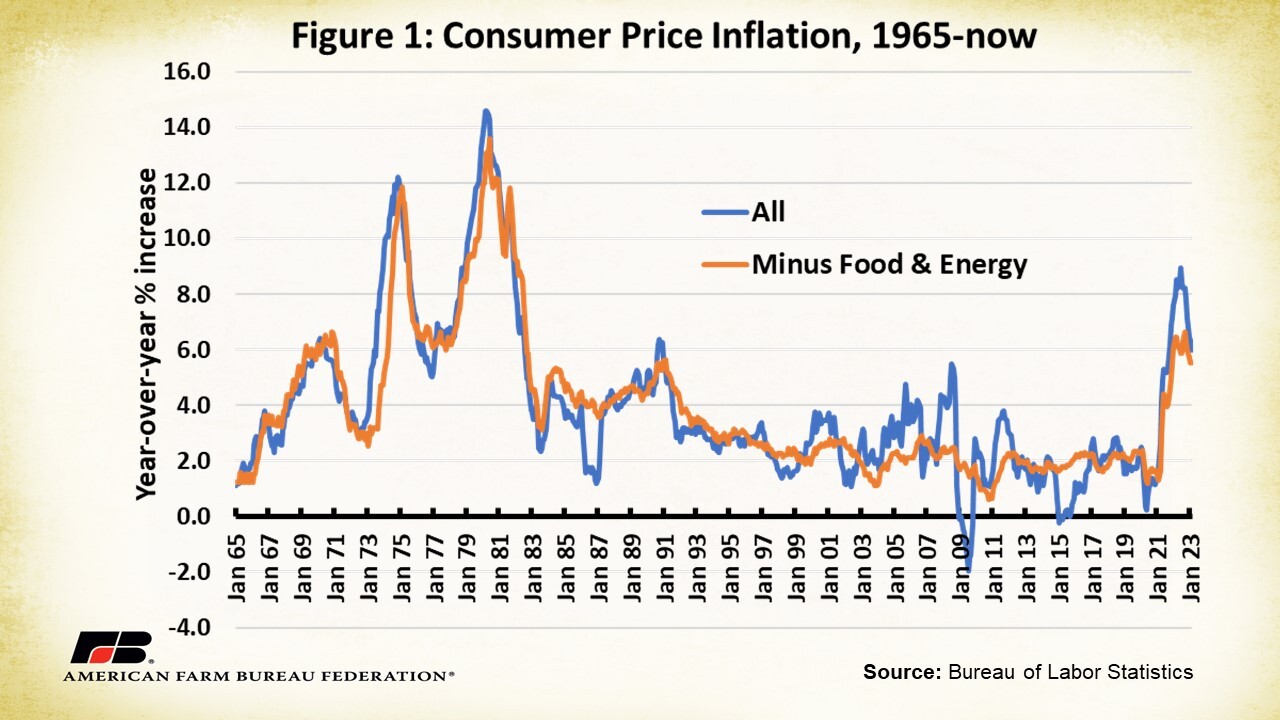

Wednesday brought a higher-than-expected consumer price reading that showed the 12-month inflation rate at 3.5%, while the Labor Department on Thursday reported that wholesale prices showed their biggest one-year gain since April 2023.

Is CPI the same as inflation : The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households.

The median estimate for the fed-funds rate target range at the end of 2025 moved to 3.75% to 4%, from 3.5% to 3.75% in December. For the end of 2026, the median dot now shows a target range of 3% to 3.25%, versus 2.75% to 3% three months ago.

Mortgage rates are expected to decline when the Federal Open Market Committee cuts the benchmark interest rate, which is likely to happen in the second half of 2024. But as long as inflation runs hotter than the Fed would like, rates will remain elevated at their current levels.

What is the optimal inflation rate

2 percent

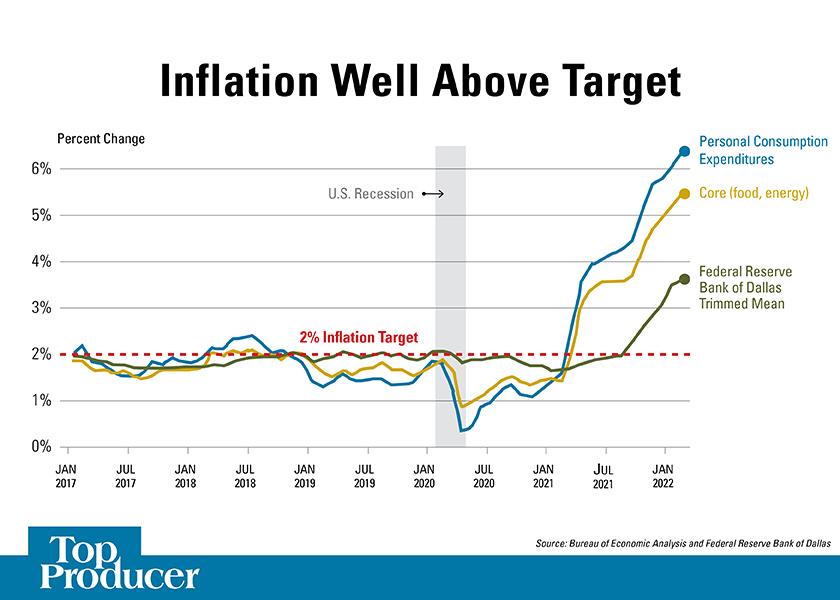

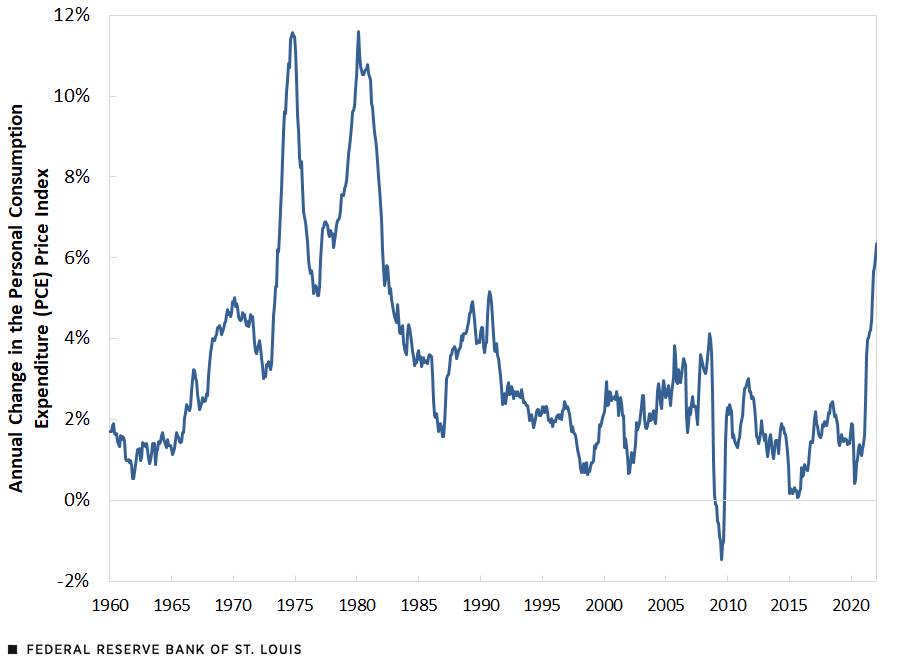

The Federal Open Market Committee (FOMC) judges that inflation of 2 percent over the longer run, as measured by the annual change in the price index for personal consumption expenditures, is most consistent with the Federal Reserve's mandate for maximum employment and price stability.The Federal Open Market Committee is scheduled to announce monetary policy decisions at 2 p.m. ET on the following dates in 2024:

- March 20.

- May 1.

- June 12.

- August 31.

- September 18.

- November 7.

- December 18.

Here are the dates of the 2024 scheduled Fed meetings: December 30-31, 2024. March 19-20, 2024. April 30 to May 1, 2024.

Basic Info. US Inflation Rate is at 3.48%, compared to 3.15% last month and 4.98% last year. This is higher than the long term average of 3.28%.

Who benefit from inflation : Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders.

Is CPI higher than inflation : The retail prices index is the older measure of inflation between the two and typically comes out highest. In February 2024, the retail prices measure of inflation, or RPI, was higher than CPI: RPI – 4.5% down from 4.9% in January. CPI – 3.4%, down from 4% in January.

Why is CPI different than inflation

For example, the CPI only measures inflation for U.S. urban populations, thus leaving out the inflation experience of people living in rural areas. It also doesn't include estimates of how different subgroups are experiencing inflation, such as the elderly or those living in poverty.

Mortgage giant Fannie Mae likewise raised its outlook, now expecting 30-year mortgage rates to be at 6.4 percent by the end of 2024, compared to an earlier forecast of 5.8 percent.Now, Fannie Mae expects rates to be a half-percent higher (6.4%) by the end of this year, and remain above 6% for another two years, gradually declining to a flat 6% by fourth-quarter 2025. Freddie Mac's latest data shows the average rate for a 30-year fixed mortgage is currently around 6.74%.

Where will interest be in 2025 : The average 30-year fixed mortgage rate as of Thursday was 6.99%. By the final quarter of 2025, Fannie Mae expects that to slide to 6.0%. Meanwhile, Wells Fargo's model expects 5.8%, and the Mortgage Bankers Association estimates 5.5%.