5.25% to 5.50%

What is the current Fed interest rate Right now, the Fed interest rate is 5.25% to 5.50%.19-20 percent

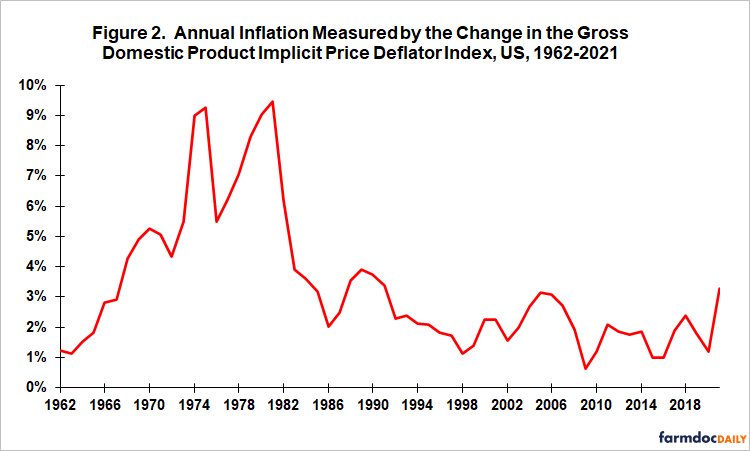

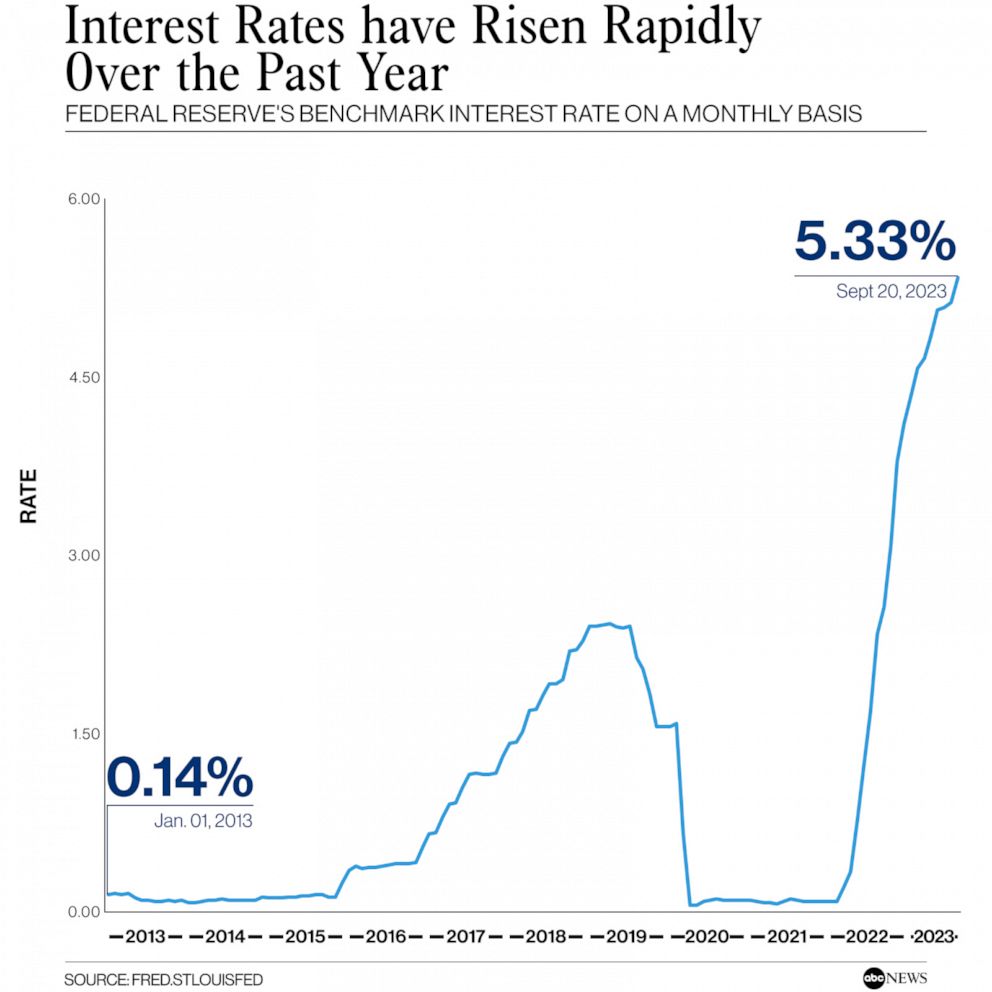

The Federal Open Market Committee (FOMC) raised interest rates 11 times in the span of about a year and a half, bringing the federal funds rate to a 23-year high of 5.25-5.5 percent. Throughout history, the Fed's key rate has been as high as 19-20 percent and as low as 0-0.25 percent.The US Fed has indicated it will cut interest rates in the latter half of 2024. It is an opportunity for investors to invest in debt funds and lock into current high yields and potential for future capital gains. US Federal Reserve expected to cut interest rates in the second half of 2024.

Will interest rates go up in USA : Mortgage rates are expected to decline when the Federal Open Market Committee cuts the benchmark interest rate, which is likely to happen in the second half of 2024. But as long as inflation runs hotter than the Fed would like, rates will remain elevated at their current levels.

What is the interest rate forecast for 2024

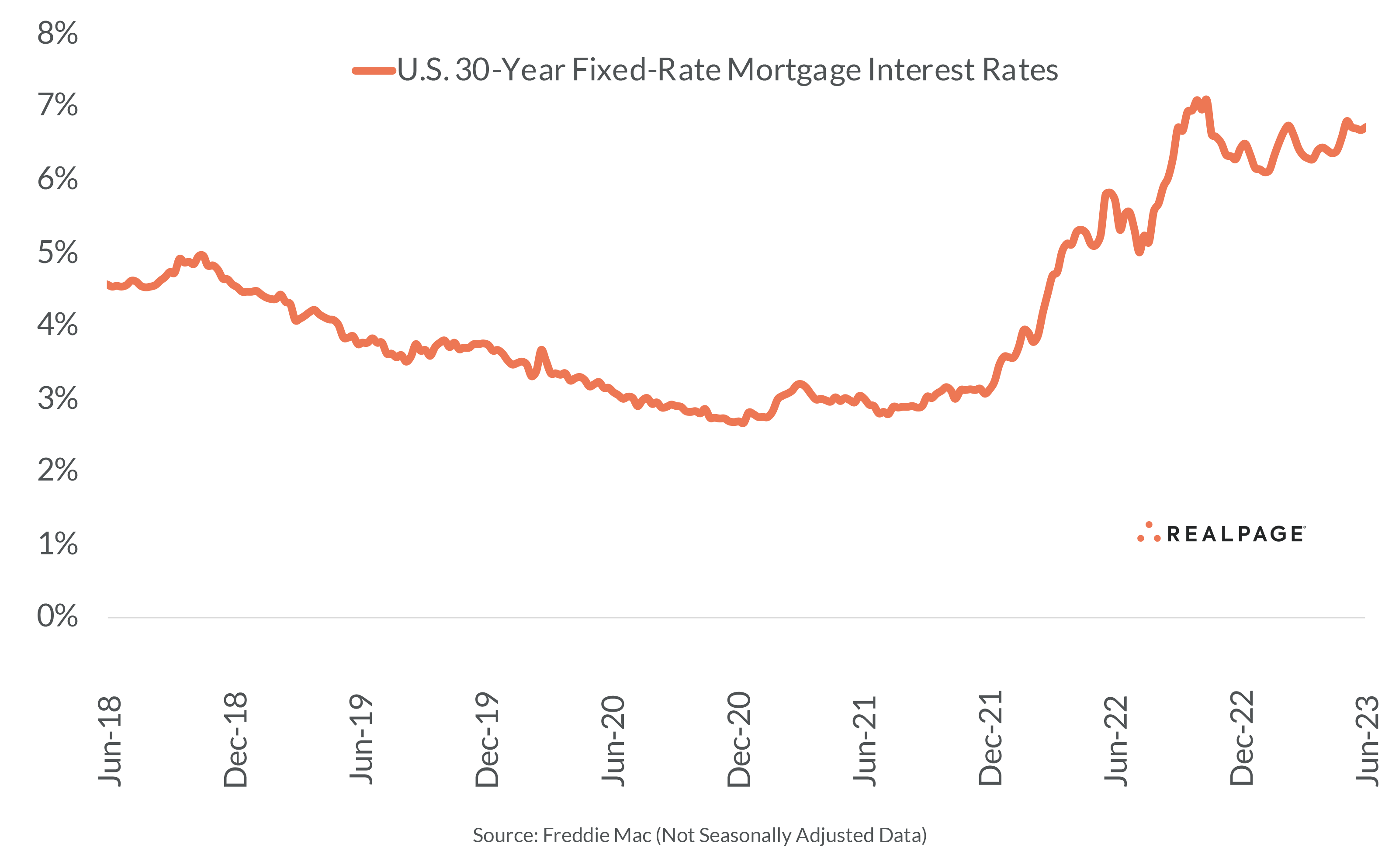

Mortgage rates are likely to trend down in 2024. Depending on which forecast you look at for housing market predictions in 2024, 30-year mortgage rates could end up somewhere between 6.1% and 6.4% by the end of the year.

What is the Fed interest rate forecast for 2024 : The new market expectation is for there to be two rate cuts in 2024, with the first one happening by September, according to the CME FedWatch tool. Rohan Reddy, director of research at Global X, a thematic ETF firm, says the latest CPI data reignited concerns about inflation, likely pushing back the timeline for cuts.

Type of account: As of April 2024, no banks are offering a 7% interest savings account. However, two credit unions are offering that rate for one of their top-tier checking accounts. Get to know the differences between checking and savings accounts to see if the APY is worth the switch.

Which Bank Gives 7% Interest Rate Currently, no banks are offering 7% interest on savings accounts, but some do offer a 7% APY on other products. For example, OnPath Federal Credit Union currently offers a 7% APY on average daily checking account balances up to and under $10,000.

How high could interest rates go in 2025

Now, Fannie Mae expects rates to be a half-percent higher (6.4%) by the end of this year, and remain above 6% for another two years, gradually declining to a flat 6% by fourth-quarter 2025. Freddie Mac's latest data shows the average rate for a 30-year fixed mortgage is currently around 6.74%.Mortgage giant Fannie Mae likewise raised its outlook, now expecting 30-year mortgage rates to be at 6.4 percent by the end of 2024, compared to an earlier forecast of 5.8 percent.Some economists — and, increasingly, investors — think that interest rates could stay higher in coming years than Fed officials have predicted. Central bankers forecast in March that rates will be down to 3.1 percent by the end of 2026, and 2.6 percent in the longer run.

Inflation and Fed hikes have pushed mortgage rates up to a 20-year high. 30-year mortgage rates are currently expected to fall to somewhere between 6.1% and 6.4% in 2024. Instead of waiting for rates to drop, homebuyers should consider buying now and refinancing later to avoid increased competition next year.

Where will interest be in 2025 : The average 30-year fixed mortgage rate as of Thursday was 6.99%. By the final quarter of 2025, Fannie Mae expects that to slide to 6.0%. Meanwhile, Wells Fargo's model expects 5.8%, and the Mortgage Bankers Association estimates 5.5%.

What will interest rates be in 2025 : The median estimate for the fed-funds rate target range at the end of 2025 moved to 3.75% to 4%, from 3.5% to 3.75% in December.

Will interest continue to rise in 2024

Heading into 2024, the Federal Reserve decided to maintain the target range for the federal funds rate at 5.25% to 5.50% and indicated that it may lower rates in the near future. Despite this prediction, you could still find high-yield savings accounts offering interest rates as high as 5.50% APY by the end of 2023.

5% APY: With a 5% CD or high-yield savings account, your $50,000 will accumulate $2,500 in interest in one year. 5.25% APY: A 5.25% CD or high-yield savings account will bring you $2,625 in interest within a year.Here's what your returns on a $10,000 balance could look like

| 0.46% APY | 5.30% APY | |

|---|---|---|

| After 1 Year | $46.00 | $530.00 |

| After 5 Years | $232.13 | $2,946.19 |

| After 10 Years | $469.64 | $6,760.37 |

30.12.2023

How can I earn 7% interest on my money : Banks that offer 7% interest on savings accounts

- Landmark Credit Union Premium Checking (7.50% APY)

- Digital Credit Union Primary Savings (6.17% APY)

- Popular Direct High-Yield Savings (5.20% APY)

- TAB Bank High Yield Savings (5.27% APY)

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Money market accounts (MMAs)