The average 30-year fixed mortgage rate as of Thursday was 6.99%. By the final quarter of 2025, Fannie Mae expects that to slide to 6.0%. Meanwhile, Wells Fargo's model expects 5.8%, and the Mortgage Bankers Association estimates 5.5%. ResiClub takes all forecasts with a grain of salt.2025/2026 UK Interest Rate Predictions

Lowest Lowest Projection for Q4 2025: 30 Rates anticipates a significant drop to 1.75%. Highest Projection for 2026: Money To The Masses sees rates at 3.74%. Lowest Projection for 2026: 30 Rates predicts a steep fall to 2.0%.Projected Interest Rates in the Next Five Years

ING's interest rate predictions indicate 2024 rates starting at 4%, with subsequent cuts to 3.75% in the second quarter. Then, 3.5% in the third, and 3.25% in the final quarter of 2024. In 2025, ING predicts a further decline to 3%.

Will interest rates be better in 2024 : Mortgage rates are expected to decline when the Federal Open Market Committee cuts the benchmark interest rate, which is likely to happen in the second half of 2024. But as long as inflation runs hotter than the Fed would like, rates will remain elevated at their current levels.

Will interest rates go up in 5 years

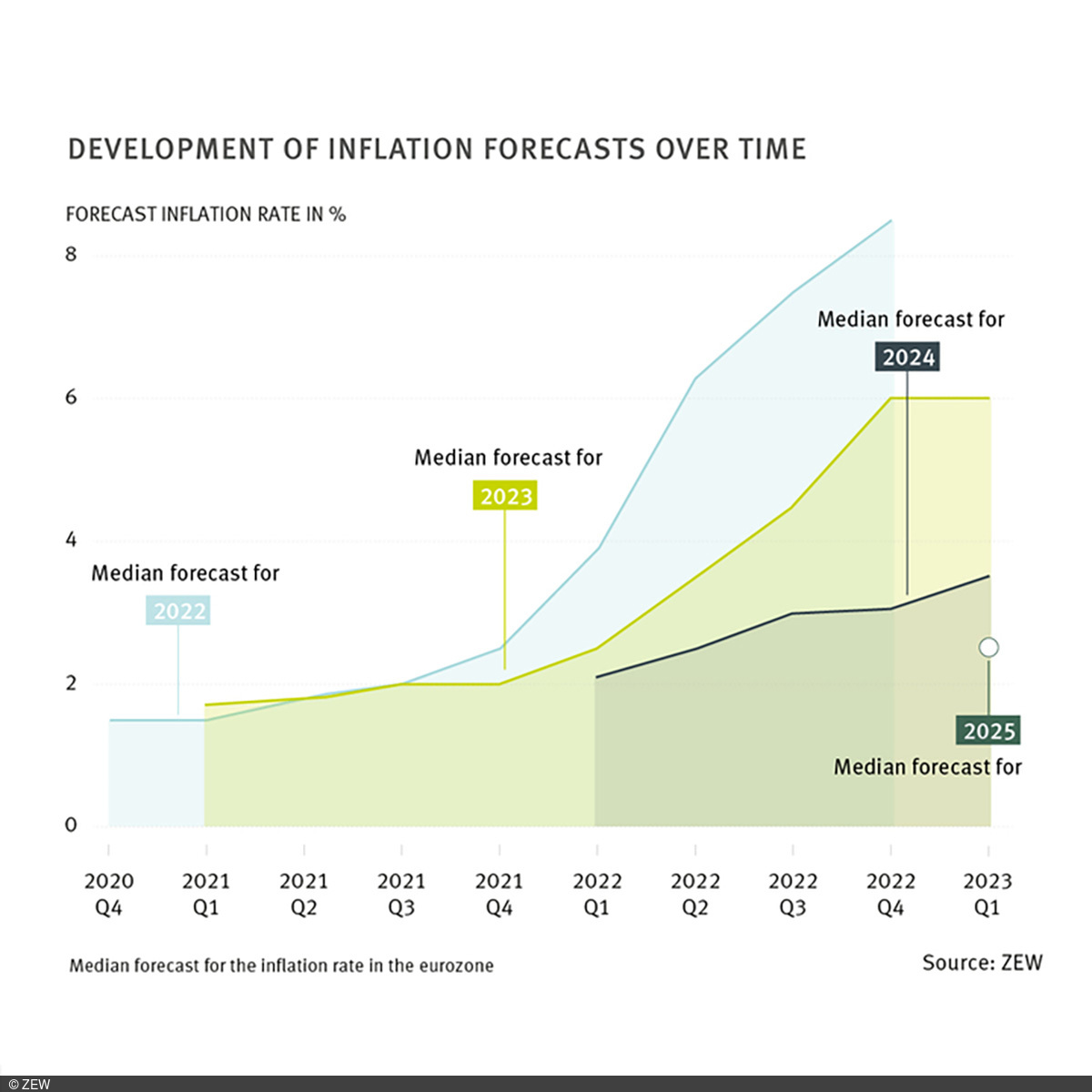

The predictions made by the various analysts and banks provide insight into what the financial markets anticipate for interest rates over the next few years. Based on recent data, Trading Economics predicts a rise to 5% in 2023 before falling back down to 4.25% in 2024 and 3.25% in 2025.

Will Fed lower rates in 2024 : The new market expectation is for there to be two rate cuts in 2024, with the first one happening by September, according to the CME FedWatch tool. Rohan Reddy, director of research at Global X, a thematic ETF firm, says the latest CPI data reignited concerns about inflation, likely pushing back the timeline for cuts.

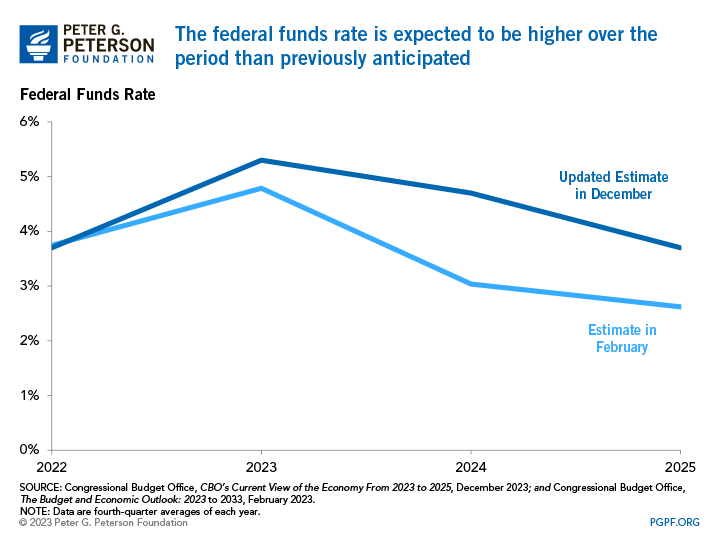

Interest Rates for 2021 to 2027. CBO projects that the interest rates on 3-month Treasury bills and 10-year Treasury notes will average 2.8 percent and 3.6 percent, respectively, during the 2021–2027 period. The federal funds rate is projected to average 3.1 percent.

Inflation is expected to fall below 2% and remain at that level from the last quarter of 2025 onwards, with the BoE projecting to cut rates from 5.25% to around 3.25% by Q1 2027, the end of its forecast period.

Should I fix my interest rate for 5 years

Deciding whether to fix your mortgage for 2, 3, 5 or even more years can be a difficult decision, as it will depend on your individual circumstances and your appetite for risk. If you're looking for certainty and peace of mind, a 5-year fixed rate mortgage may be the right choice for you.5 year fixes allow you to take advantage of rates for a longer period, and avoid the hassle and cost of remortgaging every 2 years. You could also benefit from any house price appreciation, which can increase your equity and improve your loan-to-value ratio, making you eligible for lower rates when you remortgage.The median estimate for the fed-funds rate target range at the end of 2025 moved to 3.75% to 4%, from 3.5% to 3.75% in December.

Mortgage giant Fannie Mae likewise raised its outlook, now expecting 30-year mortgage rates to be at 6.4 percent by the end of 2024, compared to an earlier forecast of 5.8 percent.

How long will interest continue to rise : I expect interest rates to stabilise around the end of 2024. The current inflation – not only in Australia but also in the US and Europe – is still way too high, so I expect the RBA to increase the cash rate a few more times this year.

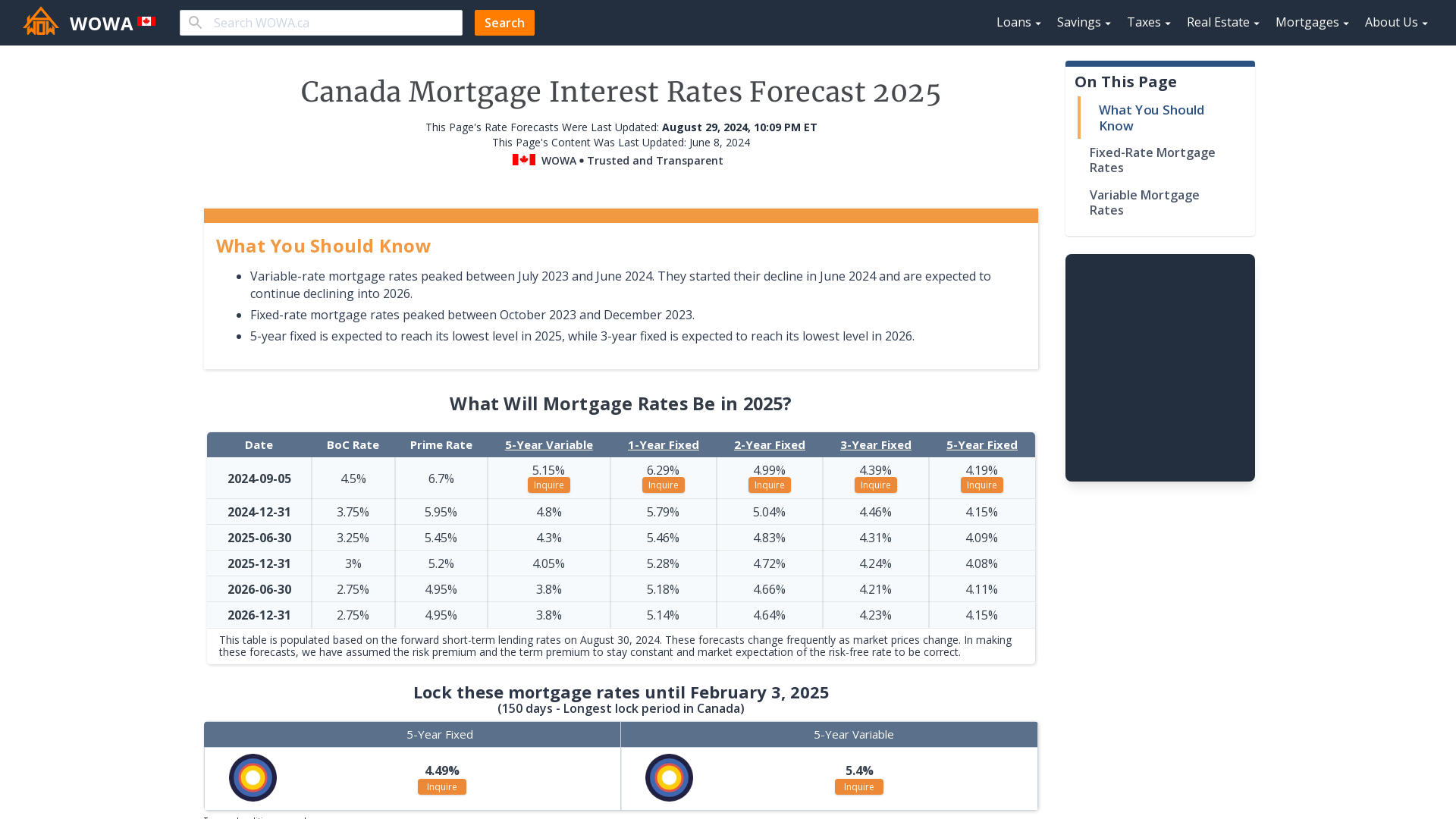

What is the prime rate forecast for 2024 : Historical Data

| Date | Value |

|---|---|

| December 31, 2024 | 3.50% |

| September 30, 2024 | 5.75% |

| June 30, 2024 | 5.75% |

| March 31, 2024 | 5.75% |

What will the fed funds rate be in 2025

Importantly, the SEP projects that the Federal Funds rate will fall to 4.6% in 2024, 3.9% in 2025, and 3.1% in 2026. This implies three 25 basis point rate cuts in 2024. We are therefore lowering our Fed Funds forecast to four 25 bps cuts this year and another four 25 bps cuts in 2025.

All consumer interest rates, including mortgage rates, should start to ease soon as inflation has been steadily trending down for over a year now. And once the Federal Reserve starts cutting the federal funds rate, which markets currently expect to happen in mid-2024, rates should drop more substantially.Homeowners are facing another five years of mortgage pain as interest rates are expected to remain higher for longer. The Office for Budget Responsibility now expects Bank of England central interest rates to settle at 4pc by the end of its forecast period in 2028-29, rather than fall to 3pc as it had assumed in March.

Should I fix for 2 or 5 years : 5 year fixes allow you to take advantage of rates for a longer period, and avoid the hassle and cost of remortgaging every 2 years. You could also benefit from any house price appreciation, which can increase your equity and improve your loan-to-value ratio, making you eligible for lower rates when you remortgage.