If your business has a taxable turnover in excess of the VAT registration threshold, you are legally required to register for VAT. Currently, the threshold is £90,000 (2024/25 tax year). However, even if your taxable turnover is below this amount, you are allowed to register for VAT voluntarily.The U.S. does not have a VAT system, but when required companies may register and report VAT in the EU, UK, Australia and parts of Asia. VAT numbers are approved by tax authorities when your company has business activities in their country that legally require VAT reporting. Do you need a VAT numberIn Germany

You need to register for VAT if: You store goods in the Germany; and. You sell them to consumers based in the Germany; and. Your sales exceed the German VAT threshold.

Do I need to be VAT registered : You must register if you realise that your annual total VAT taxable turnover is going to go over the £90,000 threshold in the next 30 days. You have to register by the end of that 30-day period. Your effective date of registration is the date you realised, not the date your turnover went over the threshold.

Who is exempt from VAT

Certain goods and services are exempt from VAT. This means that they are not subject to VAT and therefore, do not incur the standard 20% VAT charge. Exempt goods and services include insurance, education, and health services.

Can I run 2 businesses to avoid VAT : Disaggregation is when business owners seek to avoid charging VAT by splitting their business into different parts to ensure each operates under the VAT registration threshold. For a limited company, some business owners may look to establish separate companies. A sole trader may seek to establish separate trades.

If your customer is outside the European Union, you must not charge VAT. For example, if you sell goods or services to customers in the United States, you must not charge VAT.

If the service is provided to an American company outside the EU then VAT is not levied and any VAT already paid is repayable. If the service is provided in the EU then VAT is levied if the US business is consuming the service in Europe.

What businesses are exempt from VAT in Germany

The following are exempt from German VAT: export deliveries, the intra-community supply of goods, services provided by professional groups, financial services, cultural services, voluntary services. Businesses are required to register for VAT in Germany when the annual turnover exceeds a certain value.VAT NUMBER (UMSATZSTEUER)

As an individual freelancing in Germany, you may be required to obtain a VAT number (in German: Umsatzsteuer or USt-IdNr) in order to charge it to your clients and pay it to your tax office (VAT return), unless your yearly revenue is lower than 17.500 EUR.Some traders are not registered for VAT because their businesses have sales (turnover) below the VAT registration threshold and so they cannot charge VAT on their sales (unless they decide to register voluntarily – see the heading below: Voluntary registration). Also some business activities do not attract VAT.

According to the Finance Act of 2008, businesses that issue an invoice showing VAT when they are not registered are liable to pay a penalty up to 100% of the amount shown on the invoice. Even an error could lead to penalties, so you should take care to leave VAT off your invoices entirely if you're not registered.

Do I charge VAT if not VAT registered : Can you charge VAT if not VAT registered just yet The answer to this question is no, and the rules are quite clear on this issue. According to the Finance Act of 2008, businesses that issue an invoice showing VAT when they are not registered are liable to pay a penalty up to 100% of the amount shown on the invoice.

What are 3 items that are VAT exempt : VAT exempt supplies of goods and services – what are they

- Education and training.

- Insurance, finance and credit.

- Fundraising events by charities.

- Medical treatments provided by hospitals.

- Subscriptions to membership organisations.

What businesses Cannot reclaim VAT

You cannot reclaim VAT for: anything that's only for personal use. goods and services your business uses to make VAT -exempt supplies. the cost of entertaining or providing hospitality to people you do business with (for example theatre or sports tickets)

No, you do not need to pay VAT on your first £85,000 of taxable turnover. You must start paying the VAT from the date you register or when you reach the £85,000 threshold. Currently, UK VAT threshold 2024 is £85,000 of taxable turnover in a 12-month period.However if you are providing services upon the goods like maintenance/repairs then this would be a service and the Place of Supply would then be determined by where the customer belongs. So if the business customer is in Germany then the supply of services would be Outside The Scope of VAT.

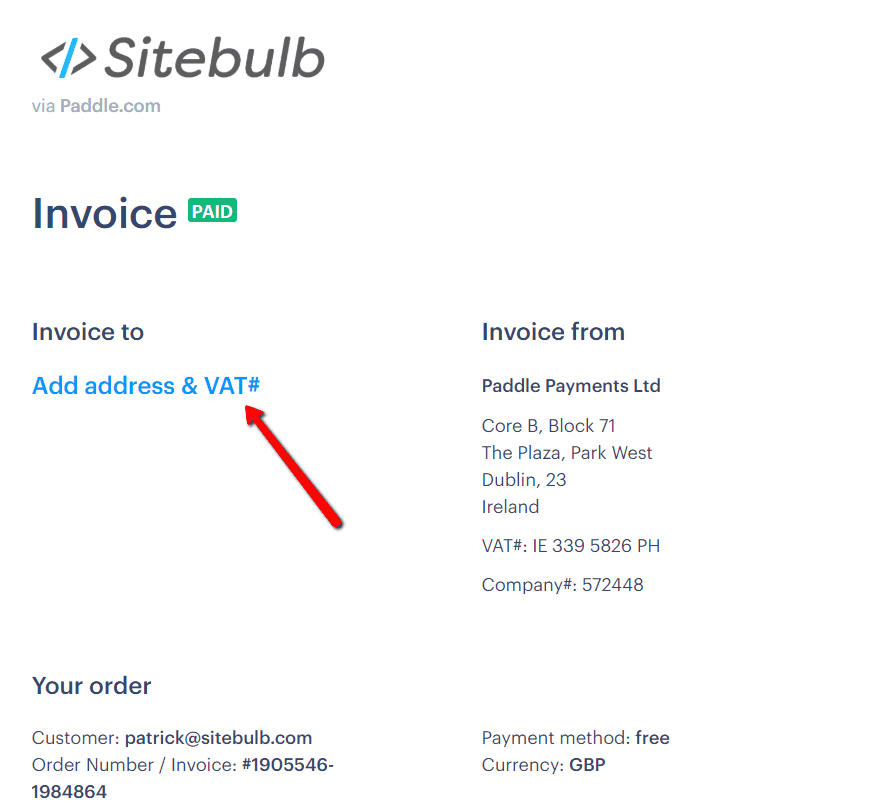

Do I charge VAT to an EU customer : If you sell goods to a business and these goods are sent to another EU country, you do not charge VAT if the customer has a valid EU VAT number. You may still deduct the VAT that you paid on related expenses, such as for goods or services purchased specifically to make those sales.