The Post-World War II hyperinflation of Hungary held the record for the most extreme monthly inflation rate ever – 41.9 quadrillion percent (4.19 × 1016%; 41,900,000,000,000,000%) for July 1946, amounting to prices doubling every 15.3 hours.Venezuela

Venezuela is the country with the highest inflation in the world, with an increase in consumer prices estimated at 360 percent in 2023, according to the latest figures from the International Monetary Fund (IMF), published in October.Prior research suggests that inflation hits low-income households hardest for several reasons. They spend more of their income on necessities such as food, gas and rent—categories with greater-than-average inflation rates—leaving few ways to reduce spending .

Who benefits from inflation : People who have to repay their large debts will benefit from inflation. People who have fixed wages and have cash savings will be hurt from inflation. Inflation is a situation where the money will be able to buy fewer goods than it was able to do so as the value of money comes down.

Why was inflation so high in Germany after ww1

One point on which historians tend to agree is that the printing of cash by the German government to make payments to striking workers in the Ruhr, who were refusing to make reparations deliveries to the Allies, contributed to hyper-inflation. The occupation of the Ruhr also caused German output to fall.

Is zero inflation good : When there is zero percent inflation, there is pressure on prices to promote spending. Economists do not advocate for a zero percent inflation rate because it leads to deflation, which is equally harmful. Deflation translates to a fall in production hence a decline in wages.

Some attribute it to excessive money printing and government spending; others point to the rise of the dollar. Many others blame inflation itself: prices go up because there is inflation, in a self-perpetuating spiral. Inflation forms an integral part of Argentina's collective memory.

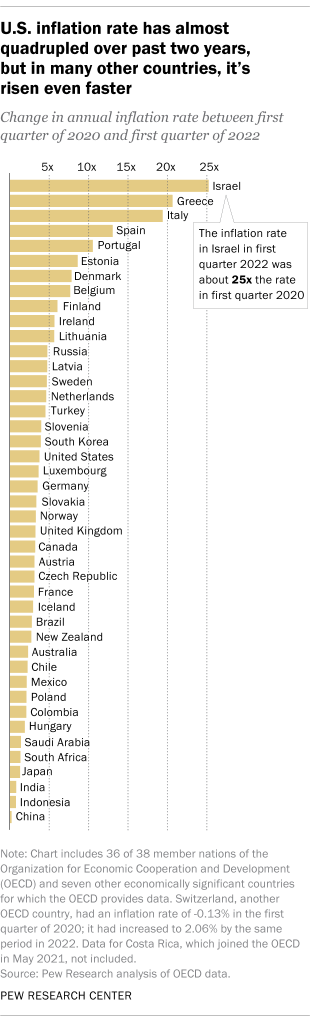

Persistently high inflation has been fueled by Turkey's dramatically weakened currency, the lira, which is at a record low against the dollar. The lira was trading at 31.43 to the greenback around noon local time on Monday.

Who in an economy is the big winner from inflation

the borrower

The big winner from inflation in an economy is the borrower and the government being the biggest borrower benefits the most from inflation. The rise in inflation will lead to higher income but the loan to be repaid remains the same.Monetary policy primarily involves changing interest rates to control inflation. Governments through fiscal policy, however, can assist in fighting inflation. Governments can reduce spending and increase taxes as a way to help reduce inflation.The main causes of inflation can be grouped into three broad categories:

- demand-pull,

- cost-push, and.

- inflation expectations.

Since your debt doesn't adjust for inflation, your debt literally becomes cheaper over time. The overall payment is worth less to you as the value of your dollar buys less over time.

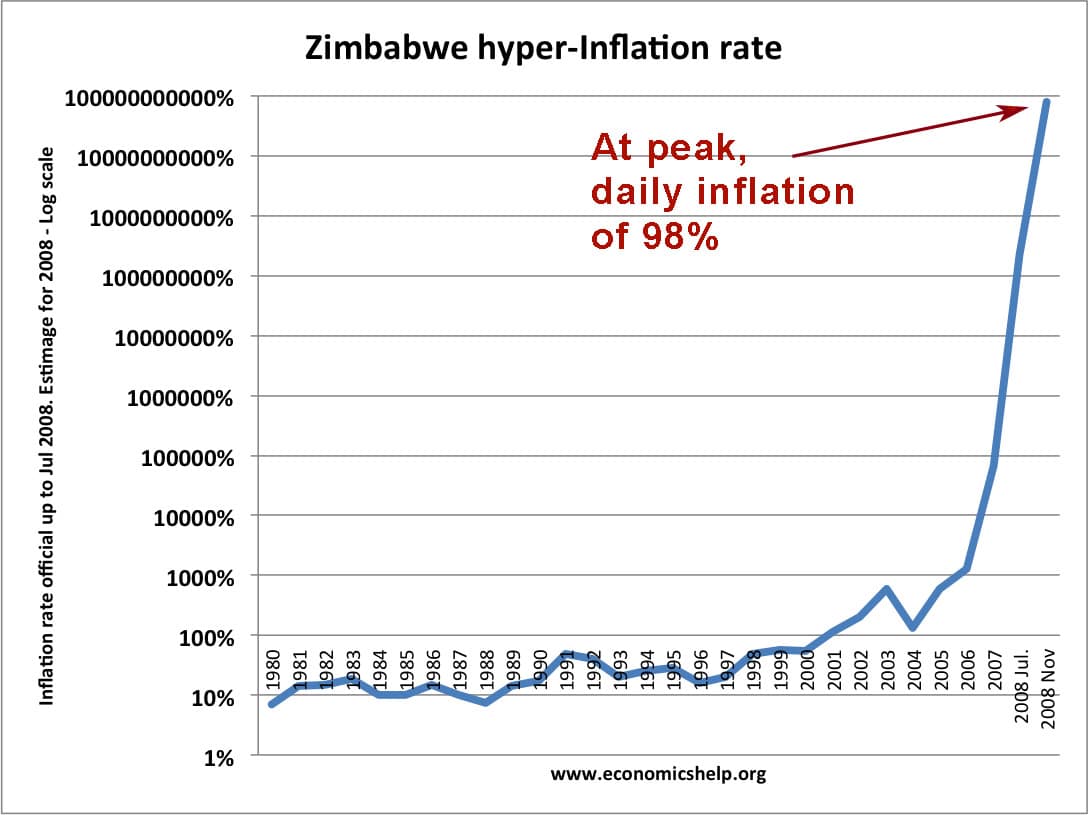

How bad was hyperinflation in Germany : That was in 1914. In 1923, at the most fevered moment of the German hyperinflation, the exchange rate between the dollar and the Mark was one trillion Marks to one dollar, and a wheelbarrow full of money would not even buy a newspaper. Most Germans were taken by surprise by the financial tornado.

How much money did Germany have to pay after ww1 : $33 billion

What countries paid reparations for WWI Germany was the only country forced to pay reparations after World War I. They were held liable for $33 billion which decimated their economy.

Why is 2% inflation better than 0

Why has the inflation target been set at 2%, rather than at 0% A price growth rate of 2% is low enough to fully reap the benefits of price stability and, at the same time, it provides a margin to reduce the risk of deflation.

In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation. Inflation can also distort purchasing power over time for recipients and payers of fixed interest rates.In high single digits Argentina's inflation hasn't been that low in decades. The rate has been higher than 100 percent for almost all of 2023..

Why is Argentina’s economy so weak : The situation worsened following the Asian crisis in 1997 and the Brazilian Real devaluation in 1998. The convertibility regime, with its fixed exchange rate, made it difficult for Argentine exports to remain competitive. The economy fell into a recession and unemployment continued climbing.

:max_bytes(150000):strip_icc()/dotdash-worst-hyperinflations-history-Final-4ba22e3b5a0e41668ecb8e30051f7a49.jpg)