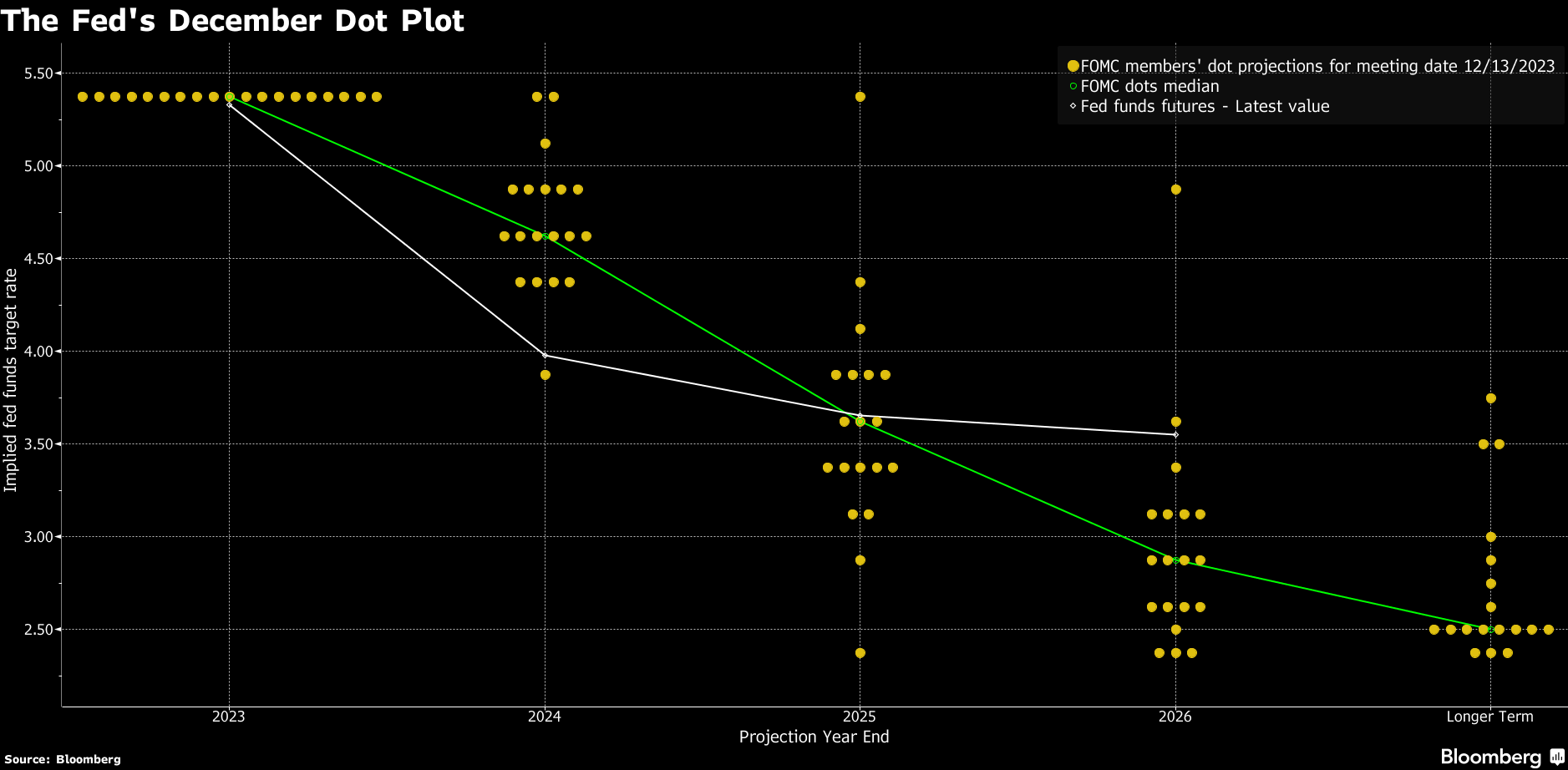

Fed chairman Jerome Powell has suggested that rates will eventually decline sometime in 2024. According to the Summary of Economic Projections, the Fed may implement at least three 25-basis point interest rate cuts in 2024—bringing the federal funds rate closer to 4.60%.Fed Funds Rate

| This Week | Month Ago | |

|---|---|---|

| Fed Funds Rate (Current target rate 5.25-5.50) | 5.5 | 5.5 |

vor 5 TagenInterest rates have held steady since July 2023.

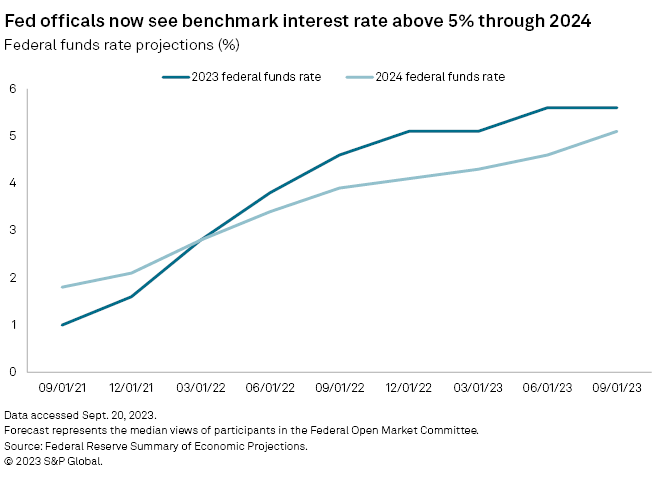

The Fed raised the rate 11 times between March 2022 and July 2023 to combat ongoing inflation. After its December 2023 meeting, the Federal Open Market Committee (FOMC) predicted making three quarter-point cuts by the end of 2024 to lower the federal funds rate to 4.6%.

Why are interest rates going up : As the cost of funds increases, lenders will need to raise interest rates to compensate. Another thing lenders need to consider is inflation. When inflation is high, the government raises rates to deter borrowers from taking loans in an effort to reduce spending.

How high could interest rates go in 2025

Now, Fannie Mae expects rates to be a half-percent higher (6.4%) by the end of this year, and remain above 6% for another two years, gradually declining to a flat 6% by fourth-quarter 2025. Freddie Mac's latest data shows the average rate for a 30-year fixed mortgage is currently around 6.74%.

What is the interest prediction for 2024 : Financial markets are currently predicting the first cut in interest rates will be in June 2024, falling to around 3% by the end of 2025, according to the latest forecasts from Capital Economics. As a general rule: if interest rates fall, the mortgage rate forecast would be for mortgage rates to fall too.

Mortgage rates are expected to decline later this year as the U.S. economy weakens, inflation slows and the Federal Reserve cuts interest rates. The 30-year fixed mortgage rate is expected to fall to the mid- to low-6% range through the end of 2024, potentially dipping into high-5% territory by early 2025.

Conversely, when the Federal Reserve decreases the federal funds rate, it increases the money supply. This encourages spending by making it cheaper to borrow.

What is the Fed interest rate forecast for 2025

The median estimate for the fed-funds rate target range at the end of 2025 moved to 3.75% to 4%, from 3.5% to 3.75% in December. For the end of 2026, the median dot now shows a target range of 3% to 3.25%, versus 2.75% to 3% three months ago.This reflects an upward revision in Fannie's analysis: Just last month, the mortgage giant expected rates would dip below 6% at the end of this year. All told, Fannie Mae predicts mortgage rates will average 6.6% in 2024 and 6.2% in 2025.Inflation and Fed hikes have pushed mortgage rates up to a 20-year high. 30-year mortgage rates are currently expected to fall to somewhere between 6.1% and 6.4% in 2024. Instead of waiting for rates to drop, homebuyers should consider buying now and refinancing later to avoid increased competition next year.

Here's where three experts predict mortgage rates are heading: Around 6% or below by Q1 2025: "Rates hit 8% towards the end of last year, and right now we are seeing rates closer to 6.875%," says Haymore. "By the first quarter of 2025, mortgage rates could potentially fall below the 6% threshold, or maybe even lower."

Will interest rates go down in 2026 : The nation's top economists say the Fed is most likely to keep interest rates higher than 2.5 percent — often considered the “goldilocks,” not-too-tight, not-too-loose level for its benchmark federal funds rate — until the end of 2026, Bankrate's quarterly economists' poll found.

What is the Fed rate projection for 2024 : On Wednesday, March 20, 2024, the Federal Open Market Committee (FOMC) voted unanimously to hold the fed funds rate at a target range of 5.25%–5.50%. While the Committee's decision fell in line with expectations, market reaction focused on the quarterly Summary of Economic Projections.

What is the prediction for interest rates in 2024

That means the mortgage rates will likely be in the 6% to 7% range for most of the year.” Mortgage Bankers Association (MBA). MBA's baseline forecast is for the 30-year fixed-rate mortgage to end 2024 at 6.1% and reach 5.5% at the end of 2025 as Treasury rates decline and the spread narrows.

While McBride had expected mortgage rates to fall to 5.75 percent by late 2024, the new economic reality means they're likely to hover in the range of 6.25 percent to 6.4 percent by the end of the year, he says.The latest projections show the median policymaker expectation is for the Fed's benchmark overnight interest rate to fall three-quarters of a percentage point in 2025, less than the 1 percentage point projected in December as part of a slightly slowed rate cut path, and by three-quarters of a point in 2026 as well, the …

What to invest in when Fed cuts rates : Corporate bonds have outperformed government bonds, on average, in the more economically-rosy scenario. The range of historical returns is wide for stocks and bonds, but both have tended to do well when the Fed has started cutting rates.